An ETF issuer is prepping a new way for investors to get exposure to the stock price of the largest publicly traded holder of bitcoin.

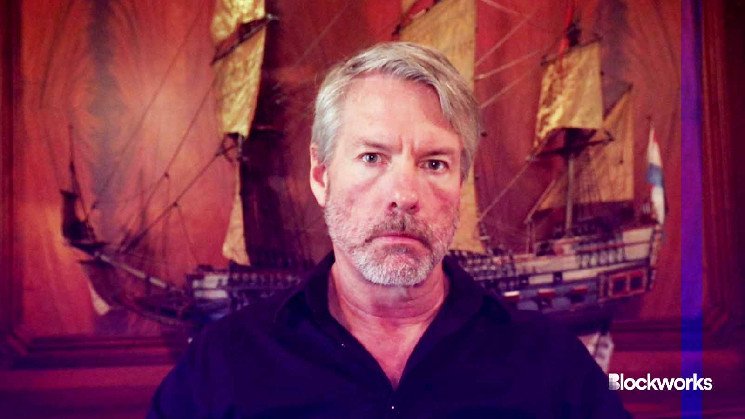

MicroStrategy, founded by bitcoin proponent Michael Saylor, currently holds 174,530 bitcoins. The company most recently revealed buying 16,130 BTC between Nov. 1 and Nov. 29.

Fund group YieldMax seeks to generate monthly income by selling and writing call options on single company stocks. The firm first proposed the YieldMax MSTR Option Income Strategy ETF (MSTY) earlier this year. It already has similar funds focused on Tesla, Coinbase, Amazon, Google and others.

“Because they are such volatile stocks, writing call options on TSLA and COIN generates a significant amount of yield for the ETFs,” said Sumit Roy, senior analyst for ETF.com. “The same would hold true for this new fund focused on MicroStrategy.”

Read more: Will MicroStrategy ever stop buying bitcoin?

The proposed actively managed ETF provides “indirect exposure” to MicroStrategy’s share price via a synthetic covered call strategy, according to a Thursday filing. MSTY would limit its potential gains, seeking to capture no more than 15% of MSTR’s share price appreciation in a given month.

It does not hold MicroStrategy shares directly.

The fund would use this strategy “regardless of whether there are periods of adverse market, economic, or other conditions,” the disclosure adds — and “will not take temporary defensive positions” at such times. It plans to launch in 2024.

YieldMax did not return a request for comment.

Roy noted that investors of ETFs using covered call strategies trade upside price appreciation potential in the stock for guaranteed yield in the form of options premiums received. Such funds tend to outperform when the underlying stocks are flat or down, while they underperform when the share prices rise rapidly.

“Some might argue that covered call strategies don’t make sense in volatile single stocks like Tesla, Coinbase and MicroStrategy because the point of those single stocks is to potentially capture big upside in exchange for taking on big risk,” he told Blockworks. “By writing calls, you are giving up most of the upside potential while keeping most of the downside risk.”

The filing comes about a month before the US Securities and Exchange Commission is expected to rule on a spot bitcoin ETF proposed by Ark Invest and 21Shares by June 10. Industry watchers expect the regulator could also approve or deny a dozen or so other similar products at that time.

StoneX research head Matthew Weller previously told Blockworks that a low-cost spot bitcoin ETF could cause demand for MicroStrategy stock — historically used by some as a proxy for bitcoin — to “dry up.”

But MicroStrategy’s Saylor said during the company’s earnings call in November that the approval of spot bitcoin ETFs would be “a catalytic event” set to benefit various players in the space, including MicroStrategy.

Saylor argued at the time that, while certain types of investors would gravitate toward bitcoin ETFs, MicroStrategy stock offers a way to get bitcoin exposure with benefits such funds won’t offer.

MicroStrategy’s stock has risen roughly 25% in the last month, as of 3:30 pm ET Friday. Bitcoin’s (BTC) price is up nearly 24% over that span.

Read the full article here