Bitcoin (BTC) has gained a new generation of hodlers in the past three years as stubborn investors refuse to sell.

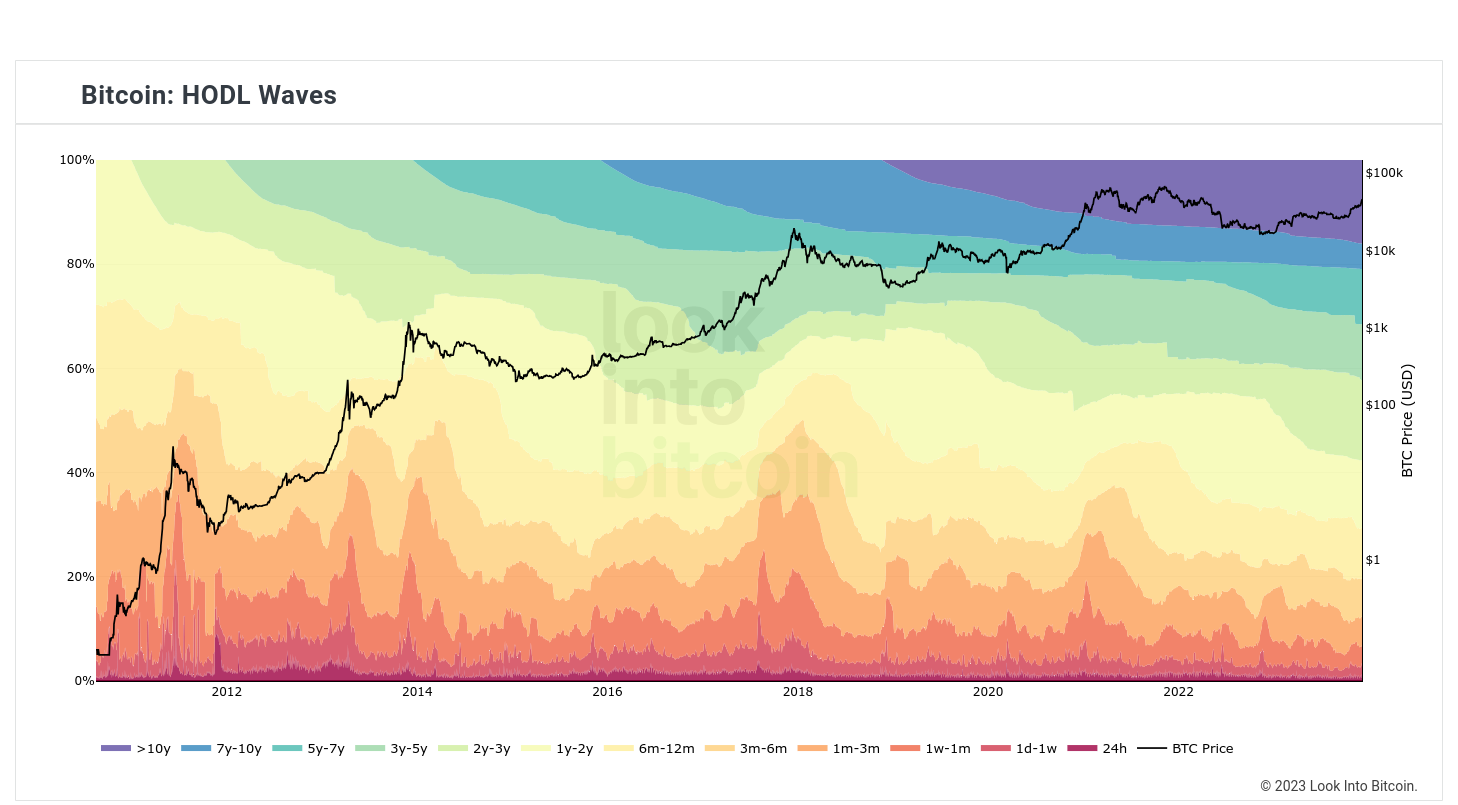

Data from the popular HODL Waves metric shows that those who bought Bitcoin in late 2020 are still sitting on their coins.

BTC price should go “way higher” for hodlers to sell

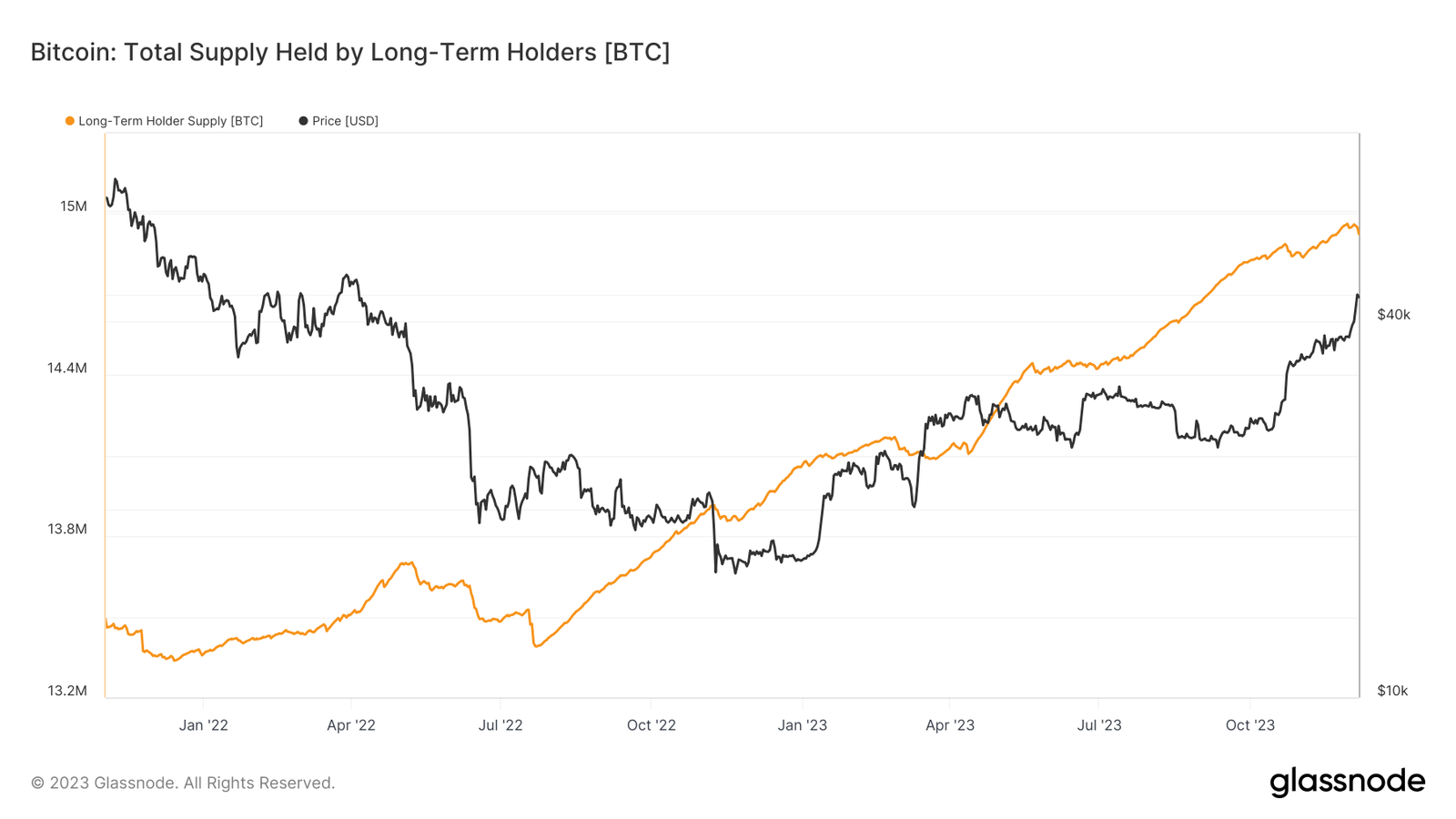

Bitcoin’s longer-term investor cohorts, also known as long-term holders (LTHs), are in no mood to decrease their exposure despite the 2023 bull run.

HODL Waves, which groups the BTC supply by the time elapsing since each coin last moved, shows a particular age band growing considerably over the past year.

Since the bear market bottomed in late 2022, unmoved coins in two to three years have increased their presence within the overall supply considerably. Last December, the group accounted for around 8% of the supply; now, its share is more than 15%.

Put another way, those who bought BTC between December 2020 and December 2021 have resisted the urge to engage in mass profit-taking.

Realized cap HODL Waves, which show the relative weighted value of coin cohorts, also reveal the biggest gain in the percentage of the total realized cap coming from two to three-year-old coins.

BTC/USD is nonetheless up 165% year-to-date, data from Cointelegraph Markets Proand TradingView confirms, making hodlers’ resilience no mean feat.

Philip Swift, creator of statistics resource Look Into Bitcoin, which hosts HODL Waves, frequently comments on the LTH phenomenon as seasoned investors become more entrenched in their positions over time.

“Bitcoin 1yr HODL wave has hardly budged so far,” he predicted about another group of hodlers last month on X (formerly Twitter).

“Long-term Bitcoiners not selling their coins until we go WAY higher.”

Speculators on the back foot

The group which contrasts with LTHs — the short-term holders (STH) or speculators — has by contrast upped profit-taking over the past week.

Related: Bitcoin is up 170% since the ECB called its ‘last gasp’ at $16.4K

As Cointelegraph reported, Bitcoin passing $40,000 triggered a snap sell response from these entities, which sold off $4.5 billion of BTC in a matter of days.

This had little impact on spot markets in an environment where LTHs already controlled more of the supply than ever before.

Per data from on-chain analytics firm Glassnode, the figure stood at 14.92 million BTC as of Dec. 6 — slightly below all-time highs of 14.95 million, or 76.3% of the supply, seen on Nov. 28.

Read the full article here