U.S. stock futures were trading in the red on Monday, with bond prices also weakening amid some tempering of recent enthusiasm over the potential for Federal Reserve interest rate cuts.

How are stock futures trading?

-

S&P 500 futures

ES00,

-0.22%

fell 11.50 points, or 0.2%, to 4,589 -

Dow Jones Industrial Average futures

YM00,

-0.16%

fell 62 points, or 0.1%, to 36,241 -

Nasdaq-100 futures

NQ00,

-0.31%

slipped 53.25 points, or 0.3%, to 15,970

On Friday, the Dow Jones Industrial Average

DJIA

rose 294.61 points, or 0.8%, to close at 36,245.50, the S&P 500

SPX

gained 26.83 points, or 0.6%, to finish at 4,594.63, scoring its highest close since March 30, 2022. The Nasdaq Composite

COMP

climbed 78.81 points to end at 14,305.03.

What’s driving markets

Last week saw the S&P 500 score its best close of the year and the Dow push past 36,000 for the first time since January 2022. That’s as expectations for the resumption of Fed rate cuts next year have pushed Treasury yields lower.

Read: Dow near record high because traders are calling bluff on ‘higher-for-longer’ Fed

But yields were creeping higher on Monday, with that of the 10-year note

BX:TMUBMUSD10Y

up 3 basis points to 4.246%. Yields tumbled Friday even after Federal Reserve Chairman Jerome Powell pushed back on rate-cut speculation, saying the central bank was prepared to hike again if needed.

Earlier last week, encouraging inflation data and comments from Fed Gov. Christopher Waller helped turbo charge rate cut expectations. A fresh, weak reading on manufacturing from the Institute for Supply Management on Friday also gave those hopes a boost.

Investors will be looking ahead to important data this week to keep supporting the case for a rate cut, with November nonfarm payrolls numbers due at the end of the week.

“Investors expect further fall in U.S. jobs openings, less than 200,000 job additions last month with slightly higher pay on month-on-month basis. The softer the data, the better the chances of keeping the Fed hawks away from the market,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank, in a note to clients.

Fed rate cut hopes, alongside rising Middle East tensions triggered a fresh high for gold prices

GC00,

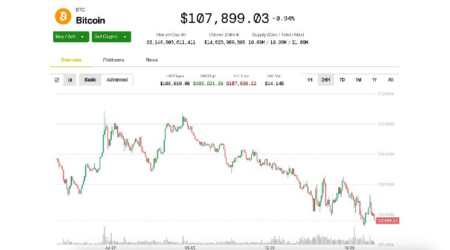

on Sunday, though the metal was paring back on Monday. Bitcoin

BTCUSD,

shot above $41,000 to a level not seen since May 2022.

Read the full article here