American banks are not out of the woods yet and are still reeling from the banking crisis that rattled the nation earlier this year. Unrealized losses continue to mount up, which isn’t a major problem until it becomes one.

On November 30, macroeconomics outlet the Kobeissi Letter reported that unrealized losses on investment securities held by US banks hit $684 billion in Q3.

US Banks Still on Shaky Ground

Recent data from the Federal Deposit Insurance Corporation (FDIC) suggests that unrealized losses have jumped to record levels.

Moreover, the third quarterly data marks a 22.5% jump compared to unrealized losses seen last year.

The increase was primarily driven by rising mortgage rates reducing the value of mortgage-backed securities held by banks, reported the outlet.

However, the FDIC doesn’t see the issue here, maintaining that banks remain “well capitalized.”

“Did the banking crisis ever really end?” questioned the Kobeissi Letter.

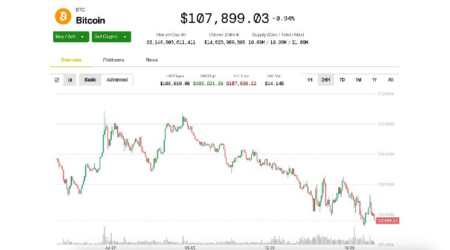

Unrealized losses on investment securities. Source: X/@KobeissiLetter

Unrealized losses are not an issue until the bank is forced to sell the assets at a loss to cover unforeseen events such as a bank run.

If people get jittery and want their deposits back all at the same time, the bank would be in trouble since it doesn’t actually hold those deposits.

Additionally, year over year, US bank profits were down 4.6%, it added. This is largely due to expenses for potential loan losses, which were up 33.2% in the last 4 quarters.

“The impact of the regional bank crisis is still being felt.”

Fed Bailout Fund Rising

Moreover, the Federal Reserve’s emergency funding facility for banks hit another record high of $114 billion. In March, the Fed launched the Bank Term Funding Program (BTFP) to bail out distressed banks, and it is still doing so.

Earlier this week, ZeroHedge reported that 64 US bank branches filed to shut down in a single week. The closure filings came from big banks such as PNC Bank, JPMorgan Chase, Citizens Bank, Bank of America, and Citibank.

It also reported the fact that banks are still accessing the bailout program, and suddenly at a faster rate, would seem to indicate that the banking sector remains shaky.

“There are still problems in the banking system bubbling under the surface.”

Read the full article here