The financial world is buzzing with news from South Korea, where traditional banking giants are making decisive moves into the digital asset space. Specifically, BNK Financial Group, a prominent financial holding company, has announced a significant stride towards the future of digital currency. Its affiliates, including BNK Financial Holdings, Busan Bank, and Kyongnam Bank, are actively filing trademark applications for Korean won stablecoins. This pivotal development signals a growing confidence in the utility and integration of blockchain technology within mainstream finance, particularly for bank-backed digital currencies. For anyone tracking the evolution of money, this represents a fascinating convergence of established financial institutions and the innovative realm of digital assets.

What are Korean Won Stablecoins and Why Are They Important?

On July 7, BNK Financial Group made headlines by confirming its affiliates are seeking trademarks related to Korean won-based stablecoins. As reported by Yonhap News, BNK Financial Holdings has submitted an impressive 11 trademark filings, while Busan Bank and Kyongnam Bank have filed 10 and 4, respectively. But what exactly are these digital assets, and why does their emergence matter for the South Korean financial landscape?

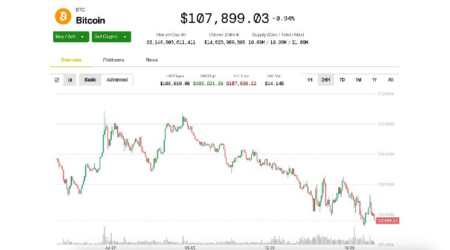

A stablecoin is a type of cryptocurrency designed to maintain a stable value, typically pegged to a fiat currency like the US dollar or, in this case, the Korean won. Unlike volatile cryptocurrencies such as Bitcoin or Ethereum, stablecoins aim to minimize price fluctuations, making them suitable for everyday transactions, remittances, and as a reliable store of value in the digital realm. A Korean won stablecoin would essentially be a digital representation of the won, allowing for faster, cheaper, and more transparent transactions on a blockchain network.

The importance of these filings cannot be overstated. They indicate:

- Increased Trust and Stability: When a major financial institution like BNK backs a stablecoin, it inherently brings a layer of trust and regulatory oversight that independent stablecoins might lack. This could encourage broader adoption among businesses and consumers.

- Efficiency in Payments: Digital won stablecoins could streamline domestic and international payments, reducing transaction times and costs significantly compared to traditional banking rails.

- Innovation in Financial Services: This move paves the way for new financial products and services built on blockchain, such as decentralized finance (DeFi) applications tailored for the Korean market.

How is BNK Financial Group Leading the Charge in South Korea’s Digital Finance?

BNK Financial Group is not just dipping its toes into the stablecoin waters; it appears to be making a strategic dive. As a prominent financial holding company in South Korea, its decision to pursue these trademark applications through its key affiliates – BNK Financial Holdings, Busan Bank, and Kyongnam Bank – underscores a deliberate push towards embracing digital innovation. This isn’t merely about creating a digital currency; it’s about positioning the group at the forefront of the evolving financial ecosystem.

The group’s engagement extends beyond just trademark filings. Both Busan Bank and Kyongnam Bank have also joined the Open Blockchain & Decentralized Identifier Association (OBDIA). OBDIA is an organization dedicated to preparing for the issuance of bank-supported stablecoins, suggesting a collaborative approach to developing the necessary infrastructure and regulatory frameworks. This membership highlights BNK’s commitment to working within a structured, industry-wide initiative rather than operating in isolation.

BNK’s proactive stance could serve as a blueprint for other traditional financial institutions in South Korea and beyond. By leveraging their existing customer base, regulatory compliance expertise, and financial stability, banks are uniquely positioned to offer reliable stablecoin solutions that could bridge the gap between conventional finance and the burgeoning digital economy. This strategic foresight could unlock new revenue streams and enhance customer loyalty in an increasingly digital world.

What Does This Mean for the South Korea Stablecoin Landscape?

The entry of BNK Financial Group into the stablecoin arena significantly reshapes the South Korea stablecoin landscape. For years, the country has been a hotbed of cryptocurrency innovation, but the involvement of major banks like Busan Bank and Kyongnam Bank brings a new level of legitimacy and potential for widespread adoption. This development could accelerate the pace at which stablecoins become an integral part of everyday financial transactions in South Korea.

Until now, discussions around digital currencies in South Korea often revolved around the Bank of Korea’s potential Central Bank Digital Currency (CBDC) or privately issued stablecoins. BNK’s move introduces a third, powerful category: bank-backed stablecoins. These differ from CBDCs, which are issued and controlled by the central bank, and from private stablecoins like Tether (USDT) or Circle (USDC), which are issued by private companies and often face different regulatory scrutiny.

The potential implications for the South Korean market include:

- Enhanced Financial Stability: Bank-backed stablecoins, with their direct links to regulated financial entities, may offer greater stability and less risk compared to some private alternatives.

- Increased Competition: This could spur other South Korean banks to explore similar initiatives, fostering innovation and competition in the digital currency space.

- Clarity in Regulation: As more traditional institutions enter, it could push regulators to provide clearer guidelines and frameworks for stablecoin issuance and usage, benefiting the entire ecosystem.

This is a crucial moment for South Korea, potentially positioning it as a global leader in the integration of traditional banking with cutting-edge blockchain technology.

Are Bank-Backed Stablecoins the Future of Digital Currency?

The trend of traditional financial institutions exploring or launching their own digital currencies, often referred to as bank-backed stablecoins, is gaining momentum globally, and BNK Financial Group’s actions are a clear testament to this. These stablecoins offer a compelling proposition, combining the innovative efficiency of blockchain with the inherent trust and regulatory compliance of established banks. But are they truly the future?

Benefits of Bank-Backed Stablecoins:

Challenges and Considerations:

- Regulatory Hurdles: While banks bring compliance, the specific regulatory framework for stablecoins is still evolving in many jurisdictions, including South Korea.

- Scalability: Ensuring the underlying blockchain can handle the volume of transactions required for mass adoption remains a technical challenge.

- Competition: They will compete with existing private stablecoins, CBDCs, and traditional payment systems.

- Privacy Concerns: Balancing the transparency of blockchain with the need for financial privacy for users.

Despite the challenges, the inherent advantages of bank-backed stablecoins – particularly their potential to bridge the gap between the traditional financial world and the digital economy – make them a strong contender for widespread adoption. They offer a familiar and secure entry point for individuals and businesses hesitant to engage with less regulated digital assets.

What’s the Outlook for Blockchain in Finance Korea?

The active participation of Busan Bank and Kyongnam Bank in the Open Blockchain & Decentralized Identifier Association (OBDIA) is a telling sign of the future direction for blockchain in finance Korea. OBDIA’s focus on preparing for the issuance of bank-supported stablecoins suggests a concerted effort to build a robust, collaborative ecosystem for digital assets within the existing financial framework. This isn’t just about one bank’s initiative; it’s about a collective industry movement.

The broader outlook for blockchain in South Korean finance is incredibly promising. Beyond stablecoins, the technology has the potential to revolutionize various aspects of banking and financial services:

- Enhanced Security and Transparency: Blockchain’s immutable ledger can improve the security of financial records and transactions, reducing fraud and increasing transparency.

- Streamlined Operations: Automation through smart contracts can reduce manual processes, leading to significant operational efficiencies in areas like trade finance, supply chain finance, and asset management.

- New Financial Products: The tokenization of real-world assets (e.g., real estate, art, commodities) could open up new investment opportunities and democratize access to previously illiquid assets.

- Improved Cross-Border Payments: Blockchain networks can facilitate faster, cheaper, and more transparent international remittances and corporate payments, benefiting both individuals and businesses.

South Korea has consistently demonstrated its embrace of technological innovation, and its financial sector is no exception. With major players like BNK Financial Group taking concrete steps, the integration of blockchain into mainstream finance is not a distant dream but a rapidly approaching reality. The nation is poised to become a significant testbed for how traditional banks can successfully leverage distributed ledger technology to modernize their services and cater to the demands of a digital-first economy.

In conclusion, BNK Financial Group’s proactive engagement in trademarking Korean won stablecoins and its affiliates’ involvement with OBDIA mark a pivotal moment for South Korea’s financial future. This strategic move by a major financial player underscores the growing inevitability of digital currencies in traditional banking. By offering stable, bank-backed digital assets, institutions like BNK are not only enhancing trust and efficiency in transactions but also paving the way for a more integrated and innovative financial ecosystem. The convergence of established finance with cutting-edge blockchain technology promises a future where digital won transactions are as commonplace and reliable as their physical counterparts, setting a compelling precedent for global financial evolution.

To learn more about the latest crypto market trends, explore our article on key developments shaping blockchain adoption and institutional integration.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Read the full article here