At the time of writing, Ether

SharpLink Gaming, Inc. (SBET) is a pioneering online performance marketing company specializing in the sports betting and iGaming industries. Headquartered in Minneapolis, SharpLink leverages its AI-powered C4 platform to deliver personalized, href=”https://x.com/SharpLinkGaming/status/1941214476776374614″>announced on X that it has become the first publicly listed company to adopt ETH as its primary treasury reserve asset. The company outlined a comprehensive treasury strategy focused on accumulating ETH, staking it, and growing ETH-per-share to create long-term shareholder value.

SharpLink emphasized that its goal is not just to hold ETH but to actively deploy it through native staking, restaking, and Ethereum-based yield strategies. The company highlighted ETH’s advantages as a corporate reserve asset: it is productive via staking rewards, composable across decentralized finance protocols, scarce, secure, and aligned with the infrastructure of the future internet. This approach represents a bold redefinition of traditional treasury management, integrating decentralized finance principles into corporate finance.

This strategic pivot began with a $425 million private placement announced on May 27, led by Consensys and other prominent crypto investors, to fund the acquisition of ETH as SharpLink’s primary treasury asset. Joseph Lubin, Ethereum co-founder and founder of Consensys, joined SharpLink’s Board of Directors as Chairman upon closing this placement, reinforcing the company’s commitment to blockchain innovation.

Since officially launching its ETH treasury strategy on June 2, SharpLink has aggressively expanded its Ethereum holdings. Between May 30 and June 12, 2025, the company acquired approximately 176,271 ETH for about $463 million at an average price of $2,626 per ETH.

Following this, from June 16 to June 20, SharpLink purchased an additional 12,207 ETH for roughly $30.7 million, funded in part by $27.7 million raised through At-The-Market (ATM) equity sales.

By June 24, SharpLink’s ETH holdings reached 188,478 ETH, with 100% of these reserves deployed in staking solutions generating staking rewards. And by July 1, the treasury expanded further to 198,478 ETH, yielding over 220 ETH in staking rewards since the strategy’s inception.

Joseph Lubin has stated that embedding Ethereum at the core of SharpLink’s capital strategy embodies technological progress and institutional trust, positioning the company to lead the evolution of digital commerce. Meanwhile, CEO Rob Phythian has noted that SharpLink’s upcoming Nasdaq closing bell ceremony on July 7, 2025, will symbolize this new chapter, showcasing how digital assets can coexist with public market discipline and corporate governance.

SharpLink’s Ethereum treasury strategy uniquely positions the company at the crossroads of sports betting, blockchain technology, and decentralized finance, offering investors regulated and transparent exposure to Ethereum’s growth potential while advancing SharpLink’s mission to innovate the multi-billion-dollar iGaming industry.

Technical Analysis Highlights

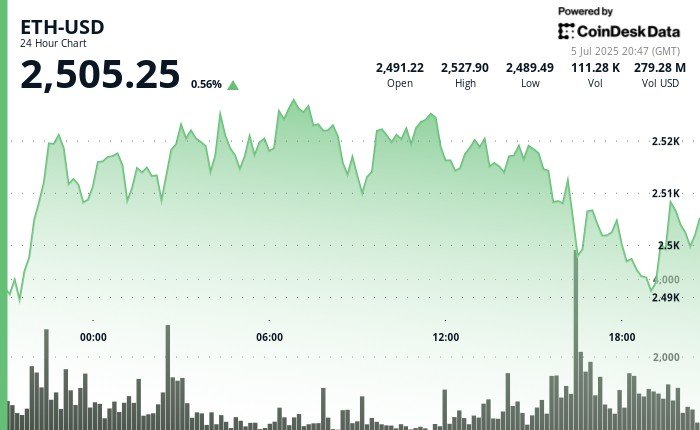

- ETH gained 2.2% from July 4 15:00 to July 5 14:00, climbing from $2,475.48 to $2,530.02.

- A sharp sell-off between 13:06 and 14:05 pushed ETH down to $2,514.85 before buyers stepped in.

- Strong support formed between $2,480 and $2,500 during the July 5 16:00 hour, with 382,821 ETH traded.

- A bullish breakout on July 4 at 22:00 lifted ETH above $2,520, with resistance confirmed near $2,530.

- ETH consolidated around $2,515 with signs of reduced volatility and an ascending recovery trendline after 13:40.

- Momentum remains neutral short-term but structurally bullish given broader uptrend since late June.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Read the full article here