Bitcoin whales have distributed thousands of BTC over the past year, as ownership of these tokens falls into the hands of institutions.

Notably, Bitcoin whales are carrying out one of the biggest hand‑offs in history. Specifically, over the last twelve months, these early, deep‑pocketed holders unloaded more than 500,000 BTC, worth north of $50 billion at today’s prices, according to Bloomberg’s review of 10x Research data.

Bitcoin Whales Offloading Their Stash

Interestingly, large exchange‑traded funds, corporate treasuries, and other institutional buyers scooped up the supply almost coin‑for‑coin. This trend has now redrawn the power map of the Bitcoin market, currently worth nearly $2.1 trillion.

Early miners, offshore funds, and long‑dormant wallets once dominated Bitcoin’s supply. However, these same Bitcoin whales have now continued to reduce their exposure while funds and companies expand theirs, Bloomberg reports.

Institutions already control roughly one-quarter of the 20 million BTC that circulate today, a share that stood far lower in 2020. ETFs alone have absorbed inflows on par with the 500,000‑BTC offload, showing how neatly the market has balanced the sell‑side pressure.

Companies and ETFs Have Added 899,190 BTC Since July 2024

For perspective, data from Bitcoin Treasuries shows that a year ago, specifically in July 2024, private companies held 279,374 BTC, while public firms held 325,407 BTC. Also, ETFs had a cumulative balance of 1,038,999 tokens.

Today, these figures have only increased. Currently, private firms hold 290,883 BTC, with public companies increasing their stash to 848,608 tokens. Moreover, ETFs now boast a balance of 1,405,479. Together, these entities have amassed 899,190 BTC worth over $96 billion since July 2024.

Bitcoin Holdings | Bitcoin Treasuries

Speaking to Bloomberg, Edward Chin, co‑founder of Parataxis Capital, said some whales bypass regular exchanges by swapping BTC for equity‑linked deals through in‑kind transfers. Notably, this practice pushes coins quietly from anonymous owners to regulated institutions and increases network activity at the same time.

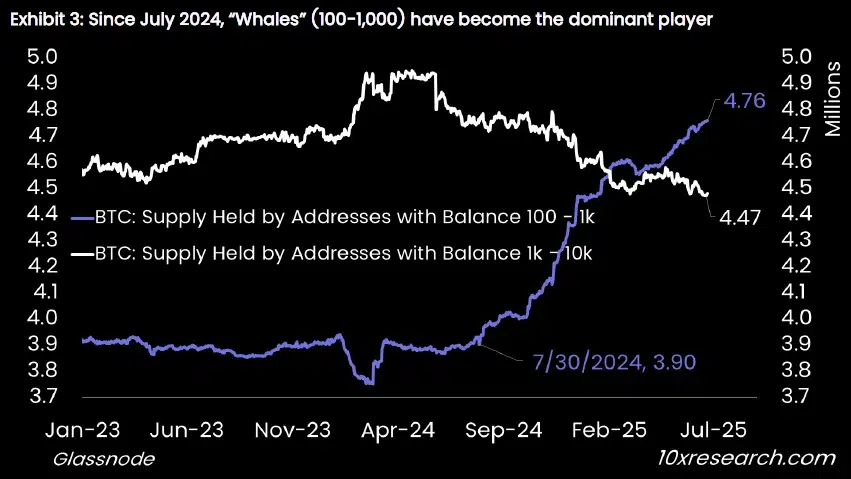

Interestingly, Bloomberg cited a chart from 10x Research, which shows a notable shift in holdings among on-chain addresses. Specifically, the balance on wallets holding 1,000–10,000 BTC fell from above 4.5 million coins in January 2023 to about 4.47 million in July 2025.

By contrast, the balance on addresses with 100–1,000 BTC jumped from 3.9 million to a hefty 4.76 million. This shows that medium‑sized holders, which are often funds accumulating on behalf of clients, are adding to their stacks while the largest owners trim theirs.

Bitcoin Whales Balance

Bitcoin Price Stalls as Volatility Fades

Notably, despite bullish developments, including growing corporate balance sheets and growing regulatory clarity, Bitcoin keeps bumping against its record of around $110,000. The Deribit 30‑day volatility gauge has dropped to a two‑year low, showing how institutional flows can smooth price swings that once defined the asset.

Speaking on this, Jeff Dorman, chief investment officer at Arca, likened modern Bitcoin to a steady dividend payer. He sees annual gains settling into a 10‑ to 20‑percent range, a far cry from the eye‑watering 1,400‑percent surge in 2017 but attractive for long‑horizon savers.

History shows what can happen if outflows intensify without equal demand. In 2018, a mere 2% net BTC outflow triggered a 74% price crash. Meanwhile, in 2022, a 9% drop in holdings led to a 64% collapse in price.

Fred Thiel, chief executive of miner MARA Holdings, noted that his firm still holds every coin it mines but warns the market sits at a delicate juncture. If whale selling resumes and institutional appetite cools, prices could lurch lower.

For now, institutional inflows continue to counterbalance whale sales. Markus Thielen, chief executive of 10x Research, believes this slow‑grind handover could run for years. As Bitcoin whales retreat and funds gain clout, the market begins to resemble more traditional asset classes featuring less hype.

At this point, investors may miss the fireworks of past bull runs, but many will welcome a calmer Bitcoin that still trends upward while slotting neatly into portfolios. Currently, Bitcoin trades for $107,886, down 1.5% in the last 24 hours.

Read the full article here