Stock markets closed at record highs on Friday and institutions went on a bitcoin buying frenzy, but the cryptocurrency’s price hasn’t seen any significant upswings.

Stocks Climb, Whales Stack, So Why Is Bitcoin Stuck in Neutral?

Both the S&P 500 and the Nasdaq closed at all-time highs on Friday. Today, the Dow is up by nearly 200 points at the time of writing. Bitcoin treasury companies like Strategy and Metaplanet have been buying bitcoin by the truckload, yet its price has barely budged.

U.S. President Donald Trump scored a couple of victories over the weekend. He put his foot down and abruptly ended all trade talks with Canada until the country’s Prime Minister Mark Carney rescinded the controversial digital services tax on American tech companies. The tax was supposed to be collected on Monday but has been officially withdrawn and will soon be axed via a legislative process. U.S.-Canada trade negotiations are expected to resume soon.

(U.S. President Donald Trump forced Canadian Prime Minister Mark Carney (right) to scrap the 3% “digital services tax” on American tech companies)

Another notch in Trump’s win column is the advancement of his “big beautiful bill” to a final Senate debate. The package received 51 yeas and 49 nays on the Senate floor on Saturday evening. Republicans are hoping to have it finalized by Independence Day if all goes well.

“ONE GREAT BIG BEAUTIFUL BILL, is moving along nicely,” Trump wrote on Truth Social. “MAKE AMERICA GREAT AGAIN!”

Experts say these small wins by the Trump administration explain, at least in part, the bullish sentiment among stock traders and investors. But crypto analysts have been left scratching their heads as the industry’s flagship cryptocurrency continues trading sideways.

Overview of Market Metrics

Bitcoin has been trading between $106,759.65 and $108,798.79 over the past 24 hours, which is a relatively tight range. The price dipped 0.65% to $107,142.61 at the time of reporting, according to Coinmarketcap, but is still up 5.33% over seven days.

( BTC price / Trading View)

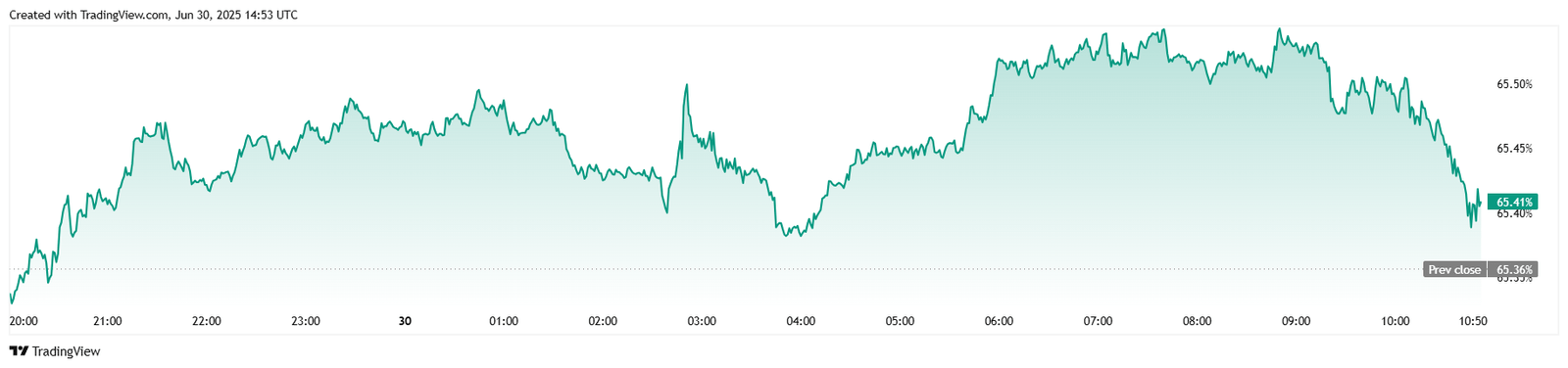

Trading volume was at $39.8 billion, up 25.4%, although this was mostly due to a typical post-weekend ramp-up. Market capitalization edged up 0.74% to $2.12 trillion and bitcoin dominance rose 0.07% to 65.41%.

( BTC dominance / Trading View)

Futures open interest fell 2.17% to $71.92 billion, suggesting less leveraged speculation. Liquidation data from Coinglass shows $47.19 million in total liquidations over the past day, with short sellers getting liquidated to the tune of $35.72 million versus $11.46 million in long positions.

Read the full article here