According to analysts, one alternative for China to combat the impending stablecoin-based dollarization and its unintended consequences is the issuance of a yuan stablecoin. This token could originate in Hong Kong, which has already enacted regulations for such instruments.

Analysts: China Has the Option to Fight Dollarization With Yuan Stablecoin

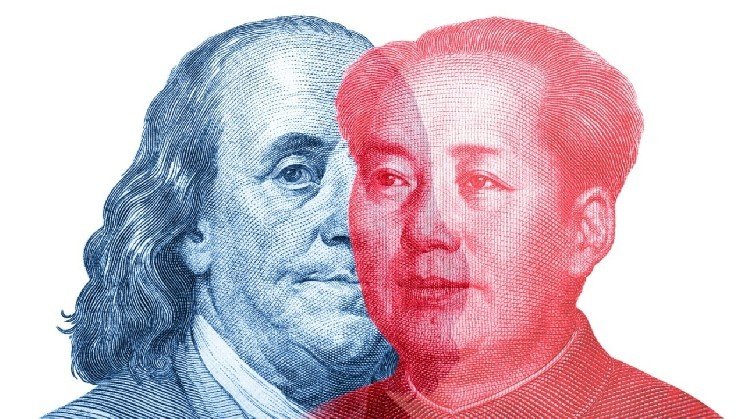

The U.S. government’s push for stablecoins as part of its strategy to extend the hegemony of the U.S. dollar has analysts examining their effects and effective ways to counter this expansion.

This week, former Chinese central bank chief Zhou Xiaochuan raised concerns about this trend, stating that while other stablecoins may be launched, U.S.-pegged stablecoins have the potential to gain global traction.

He stressed:

USD-backed stablecoins may facilitate US dollarisation, and the effects of this remain highly debated.

Furthermore, he warned that, unless facing dire straits, adopting dollarization could “bring many adverse side effects.”

Nonetheless, the rise of stablecoins seems to be unstoppable, as the combined market capitalization of the whole sector shattered the $250 billion mark this month. Even Visa, the credit giant, has recognized that money-moving institutions will have to develop a stablecoin strategy this year, as these enable faster and more effective settlements.

Alex Au, founder and chief investment officer of Alphalex Capital, has proposed to fight fire with fire, with Hong Kong developing a yuan-pegged stablecoin proposal. This could be a compelling alternative for Asian investors and serve as part of China’s yuan internationalization efforts.

In an article published on SCMP, Au stated:

The yuan was often used in quoting prices and transacting. A yuan stablecoin could help rebuild that ecosystem while offering a more efficient means of conducting cross-border trade and investment in the Chinese currency.

Furthermore, Au believes that Hong Kong should become a yuan-centered independent financial ecosystem, taking advantage of its status as a worldwide economic hub. “Rather than trying to replicate or directly compete with dollar-pegged stablecoins, it should pioneer a multipolar digital currency infrastructure that supports both regional and global transactions,” he concluded.

Read more: Stablecoins Shatter $250B Barrier in Historic Crypto Milestone

Read more: Visa: All Money-Moving Institutions Will Need Stablecoin Strategy This Year

Read the full article here