Justin Sun’s Tron is about to challenge what Wall Street considers a legitimate corporate asset, and if it fails under pressure, the fallout could ripple far beyond the company itself.

On June 16, toy maker SRM Entertainment announced it will rebrand as Tron Inc and adopt a treasury strategy centered on TRX (TRX), the native cryptocurrency of the Tron blockchain.

The move — widely defined as a reverse merger — is backed by a $100-million private investment, potentially rising to $210 million if warrants are fully exercised. Tron founder Sun will serve as an adviser.

Tron’s strategy puts TRX to the test as a corporate reserve asset. While Bitcoin (BTC) has gained traction on public balance sheets, TRX is more thinly traded, centrally controlled and closely tied to the company itself.

Tron’s TRX strategy is riskier than Bitcoin treasuries

In the first half of 2025, a growing number of publicly traded companies adopted cryptocurrencies in their treasuries. Strategy (formerly MicroStrategy) popularized the aggressive Bitcoin acquisition playbook that inspired global firms to follow suit in hopes of reversing the fortunes of its slumping shares.

Now, companies are anchoring treasury plans around assets like Ether (ETH), Solana (SOL) and XRP. But the shine is wearing off, as announcing a crypto treasury strategy is no longer a guaranteed path to a soaring stock price.

“[Michael] Saylor has a lot of experience with structured products, being a listed company, financial legality and processes, a now long-standing process for crypto flows and a clear investor offering. A lot of these newer vehicles do not,” Justin d’Anethan, head of sales at token launch and distribution platform Liquifi, told Cointelegraph.

“While I can’t say they’ll necessarily mess up, there’s just an implied higher risk,” he added.

Sun’s plan stands apart from other crypto treasuries. If realized, Tron Inc would become the first US company to hold its own blockchain’s native token as a corporate reserve.

Jamie Elkaleh, marketing chief at Bitget Wallet, told Cointelegraph:

“The company is essentially holding its own equity-like asset as collateral. This is circular and risky.”

“If confidence in Tron Inc falters, TRX may drop, which then tanks Tron Inc’s perceived value even further,” he added, highlighting a feedback loop.

Tron and SRM Entertainment did not respond to Cointelegraph’s request to comment.

Related: New Bitcoin treasuries may crack under price pressure

TRX is one of the largest cryptocurrencies by market capitalization. As of June 17, it ranks eighth with $26.2 billion. But unlike Bitcoin, TRX lacks comparable institutional demand and trades with much lower volume, CoinGecko data shows.

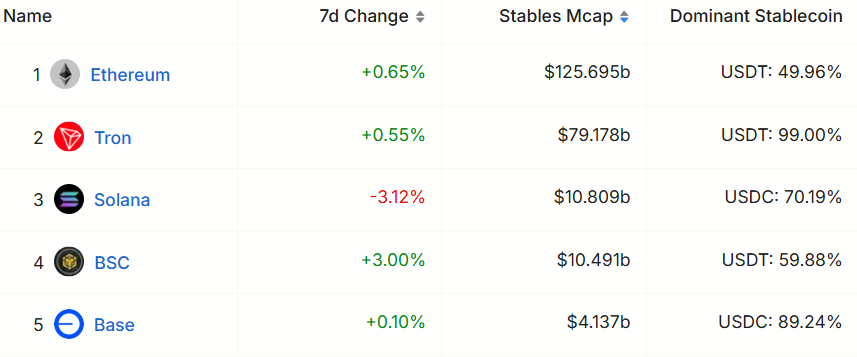

Despite Tron’s announcement, TRX recorded a 24-hour trading volume of just $1.75 billion as of June 17 — far below Bitcoin’s $34.3 billion and trailing other treasury coins like XRP and Solana. But Tron is far from a ghost chain and boasts one of the most active ecosystems in the industry.

“To be fair, Tron’s been around and plays a major role in stablecoin flows, so there’s real activity under the hood,” d’Anethan said.

TRX launched on Ethereum in August 2017 and migrated to its own blockchain in June 2018. It has weathered multiple bear markets and grown into the second-largest network for stablecoins, with the largest circulation footprint of Tether’s USDt (USDT) in the world.

A chunk of Tron’s stablecoin flows have been tied to illicit finance, but the network has made efforts to curb abuse.

Eric Trump denies position in new Tron company

What surprised many market watchers about Tron’s public listing plan was the reported involvement of Eric Trump, son of US President Donald Trump, in the new TRX treasury firm.

Eric Trump has since denied any “public involvement” with Sun’s new venture. However, he does have a connection to Dominari Securities, the broker-dealer serving as exclusive placement agent for the deal. In February, Eric Trump and his brother Donald Trump Jr. joined Dominari’s advisory board.

“The involvement of politically connected individuals in tech enterprises is not unprecedented,” Yuriy Brisov, a partner at Digital and Analogue Partners, told Cointelegraph, adding, “Such associations can lead to scrutiny regarding the impartiality and independence of tech firms.”

Related: WLFI’s DeFi credentials under fire after Sui partnership

Sun recently claimed to be the largest holder of Trump’s memecoin and won a dinner invitation with the president as a top tokenholder.

On June 11, Sun announced that the first batch of USD1 — a stablecoin issued by World Liberty Financial, a so-called DeFi project linked to the Trump family — had been minted on the Tron network. Sun was identified as the project’s largest investor and an adviser.

Tron’s reverse listing or Circle’s IPO?

Tron’s announcement comes after Circle’s successful public debut through an initial public offering. Its USDC (USDC) stablecoin is the seventh-largest cryptocurrency by market cap, ranking one position ahead of TRX.

Brisov calls Circle’s approach more transparent compared to the SRM deal:

“Blockchain companies usually prefer more transparent paths to public offerings to reassure potential investors, who are traditionally hesitant toward crypto firms. That’s why the route Circle chose appears more robust now.”

The Tron deal has been described as a reverse merger, a shortcut to the stock market that allows private companies to go public by taking over an existing listed entity, in this case, SRM.

In the 2000s, numerous companies from China used this method to list on US exchanges. However, several later faced allegations of financial misconduct, prompting increased regulatory scrutiny and delistings, Brisov pointed out.

This connection doesn’t imply wrongdoing in all reverse mergers. The Securities and Exchange Commission tightened its reverse listing rules in 2011 following a wave of China-based firms entering US markets.

The SEC and Tron also have unfinished business, as the agency alleges that Sun and his companies sold unregistered securities through TRX and BitTorrent (BTT).

According to Brisov, this raises questions about compliance with securities regulations. If TRX is deemed a security, Tron Inc could face additional regulatory obligations.

In February, the market watchdog asked a US federal court to pause its case against Sun and his companies.

Magazine: Older investors are risking everything for a crypto-funded retirement

Read the full article here