Bitcoin hovered at $105,049 on June 15, 2025, with a market capitalization of $2.08 trillion and a 24-hour trading volume of $15.86 billion. The leading crypto asset traded within a narrow intraday range of $104,412 to $106,032, indicating subdued price action and investor indecision near key technical levels.

Bitcoin

The hourly chart for bitcoin reveals a minor downtrend, punctuated by attempts to consolidate near short-term support at $104,500. Price action exhibits an inverted cup pattern, typically signaling a bearish continuation; however, selling momentum has eased. While the 1-hour chart shows no confirmed bullish reversal, an entry above $105,800 could trigger a brief scalping opportunity with targets between $106,200 and $106,500. A break below $104,400 would negate any upside bias. This chart illustrates a market in search of direction, underpinned by low conviction moves.

BTC/USD 1-hour chart via Bitstamp on June 15, 2025.

In the 4-hour timeframe, bitcoin is exhibiting sideways behavior following a sharp decline to $102,816, suggesting temporary stabilization. Volume spikes on the initial sell-off imply potential capitulation, but the lack of follow-through leaves the trend direction ambiguous. A confirmed close above $106,000 with supporting volume would support a short-term breakout toward the $108,000–$109,500 range. Conversely, a breach below $104,000 could accelerate further losses. This consolidation pattern is characteristic of a market on pause after a volatile move.

BTC/USD 4-hour chart via Bitstamp on June 15, 2025.

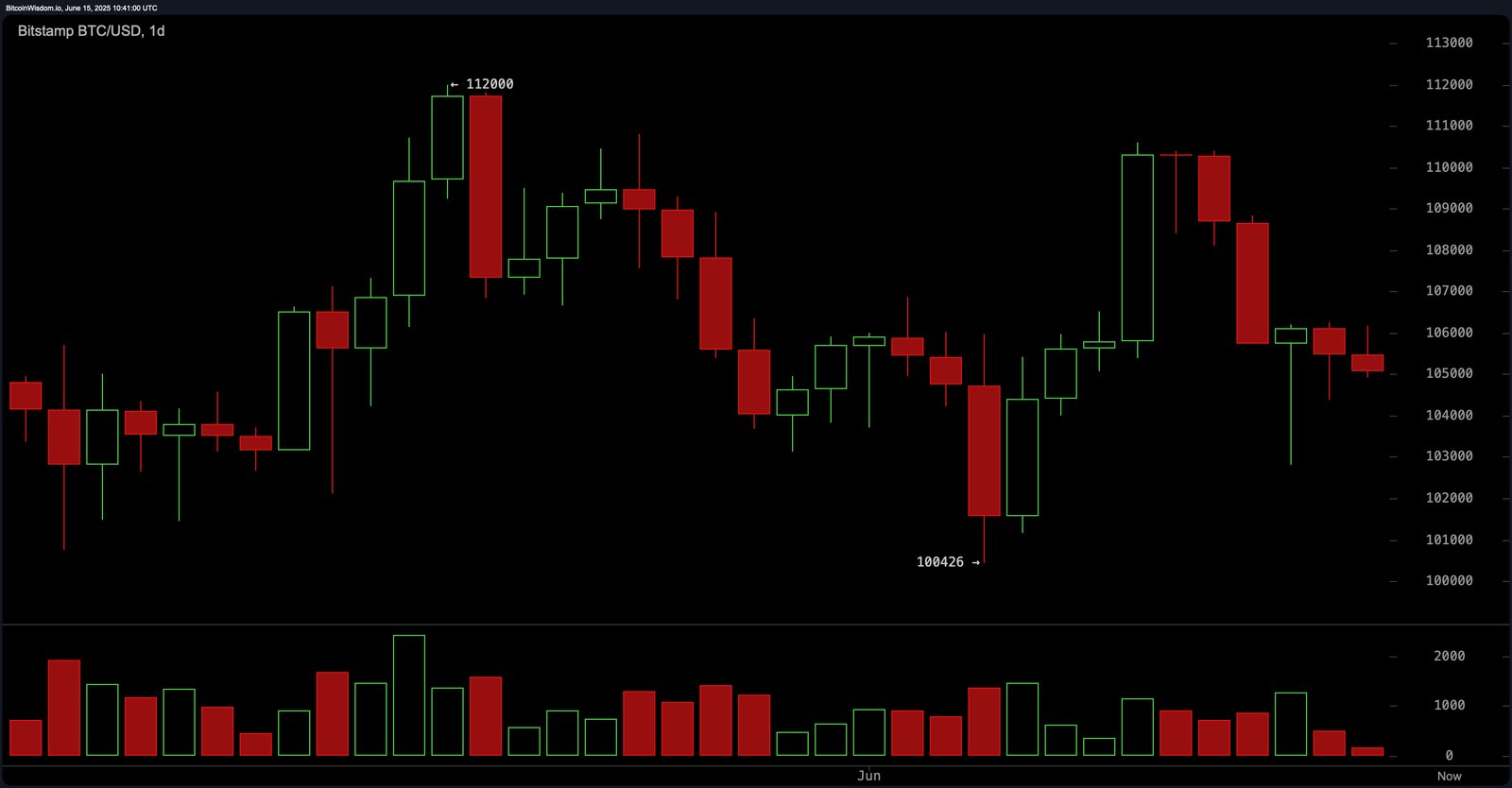

The daily chart presents a more pronounced downtrend, beginning after a failed attempt to surpass the $112,000 level. The double top and subsequent formation of lower highs have established a bearish technical structure. Key support lies between $100,000 and $102,000, a zone that has repeatedly absorbed selling pressure. Despite waning volume on down days—a sign of weakening bearish strength—momentum remains unfavorable. A bullish engulfing candle or similar reversal signal above $100,500 could mark the beginning of a swing-long opportunity with exit targets near $112,000.

BTC/USD 1-day chart via Bitstamp on June 15, 2025.

Oscillators provide a mixed signal landscape. The relative strength index (RSI) is at 49, indicating neutral momentum, while the Stochastic oscillator is also at a neutral 50. The commodity channel index (CCI) stands at −29, the average directional index (ADX) is at 18, and the Awesome oscillator reads 301—each suggesting a lack of trend strength. The only bullish signal among oscillators comes from momentum, showing a value of 3,479, indicating residual upside force. The moving average convergence divergence (MACD) at 712, however, signals negative sentiment, reflecting ongoing bearish pressure on the medium-term trend.

Moving averages (MAs) show a broader cautionary tone. The 10-, 20-, and 30-period exponential moving averages (EMAs) and simple moving averages (SMAs) are all above the current price and indicate bearish signals, with levels clustered between $105,166 and $106,744. However, the 50-, 100-, and 200-period EMAs and SMAs all show bullish signals, suggesting long-term optimism remains intact. This divergence reinforces the notion of a medium-term pullback within a longer-term uptrend.

Bull Verdict:

If bitcoin maintains support above the $100,000 threshold and confirms a reversal pattern with increasing volume, bullish momentum may resume. This would position the asset for a move back toward the $110,000–$112,000 resistance range, aligning with long-term buy signals across the 50-, 100-, and 200-period moving averages.

Bear Verdict:

Failure to hold above $104,000, coupled with continued weakness in momentum indicators and resistance from short-term moving averages, could extend bitcoin’s decline. A breakdown below $100,000 would likely trigger increased selling, potentially targeting the mid-$90,000s in alignment with a prevailing medium-term bearish structure.

Read the full article here