Bitcoin hovered at $109,319 as of June 11, 2025, showing resilience amid a cooling phase. The cryptocurrency posted a market capitalization of $2.17 trillion and a 24-hour trading volume of $32.03 billion, with price action ranging from $108,633 to $110,237.

Bitcoin

On the 1-hour chart, bitcoin displays short-term indecision following a quick rejection from $110,400, which created a localized top. The price has since flattened around the $109,500 mark, with markedly low volume suggesting reduced conviction among traders. Entry opportunities are contingent on a breakout above $110,400 or a breakdown below $108,500. Given the muted momentum, only quick trades with narrow profit targets—typically within a 100–200 point range—are advisable at this timeframe.

BTC/USD 1-hour chart via Bitstamp on June 11, 2025.

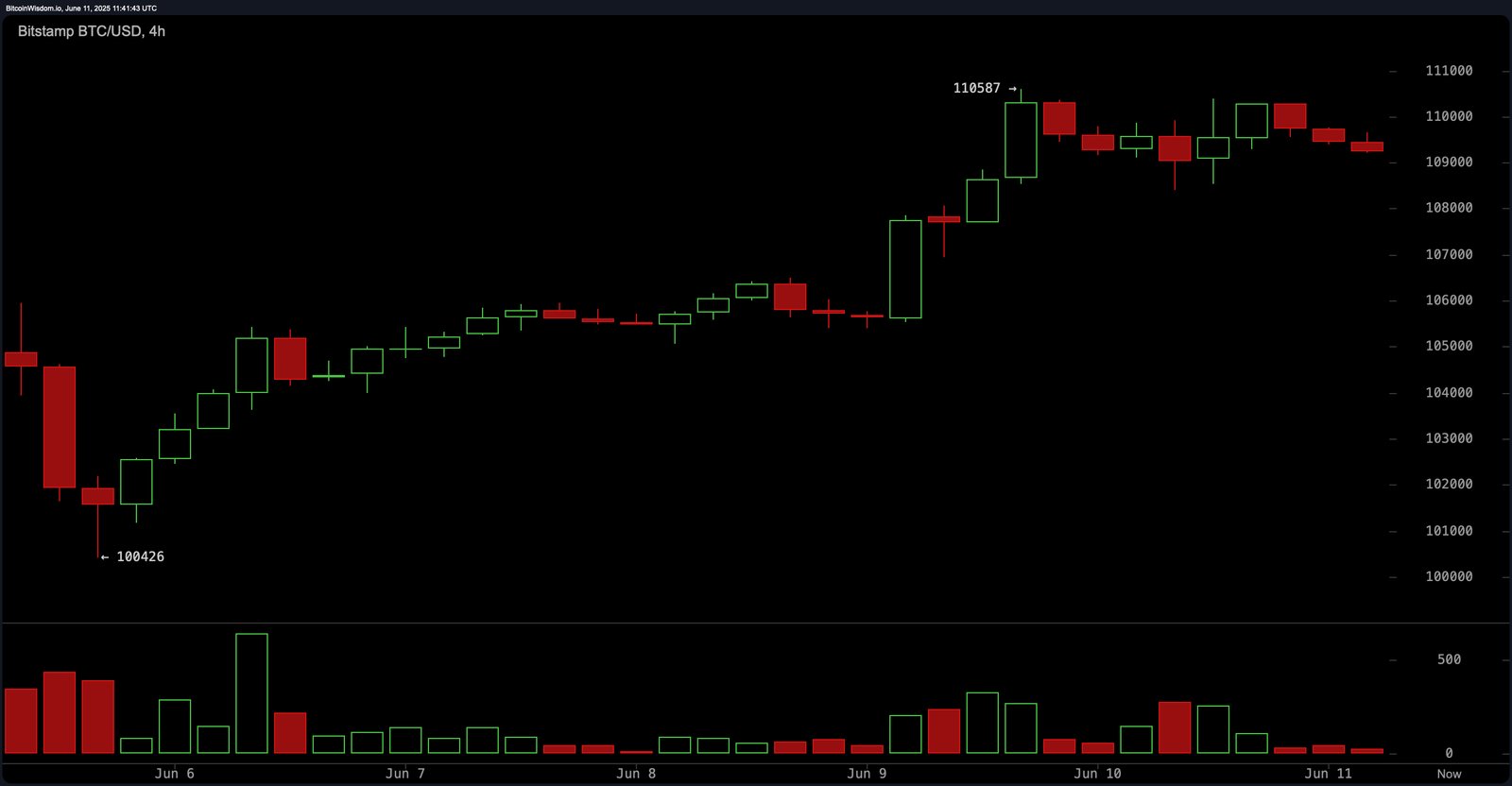

The 4-hour bitcoin chart reveals a recent V-shaped recovery from $100,426 to $110,587, succeeded by sideways consolidation. This pattern resembles either a bullish flag or an early distribution phase. A decisive breakout above $110,600 on increasing volume may initiate another leg higher, while a breakdown below $109,000 could trigger a retracement. Traders may consider aggressive entries on strength or accumulate near $108,000 if supported by signs of demand.

BTC/USD 4-hour chart via Bitstamp on June 11, 2025.

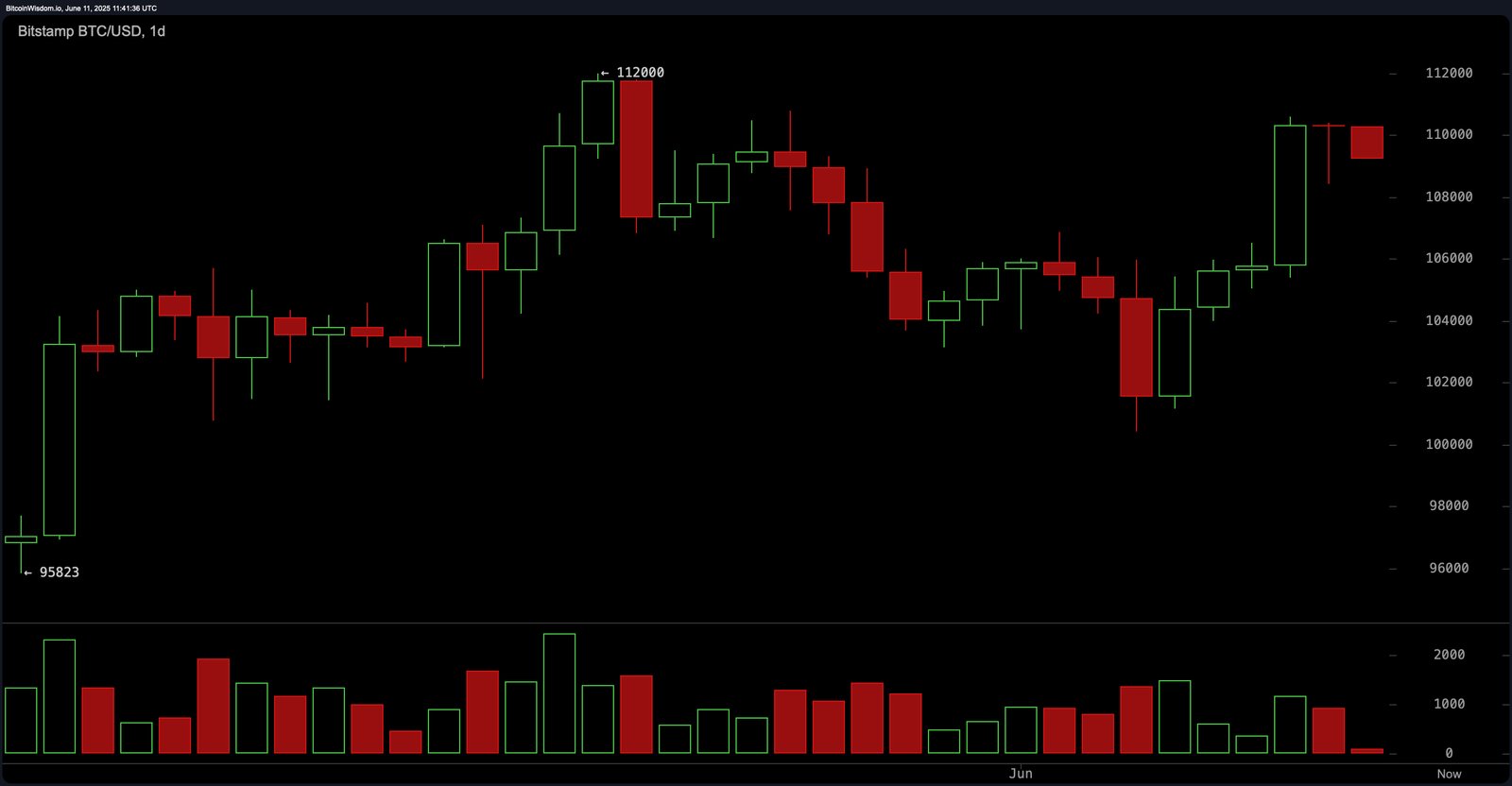

Looking at the daily chart, bitcoin has experienced a bullish rally to $112,000, followed by a correction to the $101,000 level and a partial recovery. Despite this upward trajectory, recent candles indicate hesitancy—low green-day volume and a red candle post-surge imply reduced buying pressure. Key support sits between $100,000 and $101,000, while resistance looms at $112,000. Prudent traders may await a breakout above $112,000 or a dip back to support with a tight stop-loss below.

BTC/USD daily chart via Bitstamp on June 11, 2025.

Oscillator readings across the board point to a neutral stance, reinforcing the market’s current ambiguity. The relative strength index (RSI) is at 60, Stochastic at 93, commodity channel index (CCI) at 98, average directional index (ADX) at 18, and the awesome oscillator at 1,719—all signaling neutrality. Momentum, however, shows a value of 3,523 and suggests a sell bias, whereas the moving average convergence divergence (MACD) at 1,469 is in buy territory.

All major moving averages support a bullish outlook. The exponential moving average (EMA) and simple moving average (SMA) from 10 to 200 periods are uniformly flashing buy signals. Notably, the 10-period EMA stands at $107,307 and the 200-period SMA at $95,480, reinforcing a strong long-term uptrend. With prices well above these averages, the underlying trend remains structurally positive, despite short-term consolidation.

In summary, bitcoin appears to be in a temporary cool-off phase within a broader bullish framework. Traders should remain patient, favoring confirmation-based entries either on a breakout beyond $112,000 or a tactical pullback toward $100,000. Until such signals emerge, a cautious stance is warranted given the neutral oscillator alignment and low-volume drift.

Bull Verdict:

Bitcoin remains structurally bullish, with strong support from all major moving averages and the potential for renewed upward momentum on a breakout above $112,000. A sustained push above this resistance could reignite buying interest and set the stage for a fresh rally.

Bear Verdict:

Despite the longer-term bullish trend, signs of waning momentum and neutral oscillator readings suggest vulnerability to a short-term pullback. A breakdown below $108,000, especially on rising volume, could signal a deeper correction toward the $100,000 support zone.

Read the full article here