Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

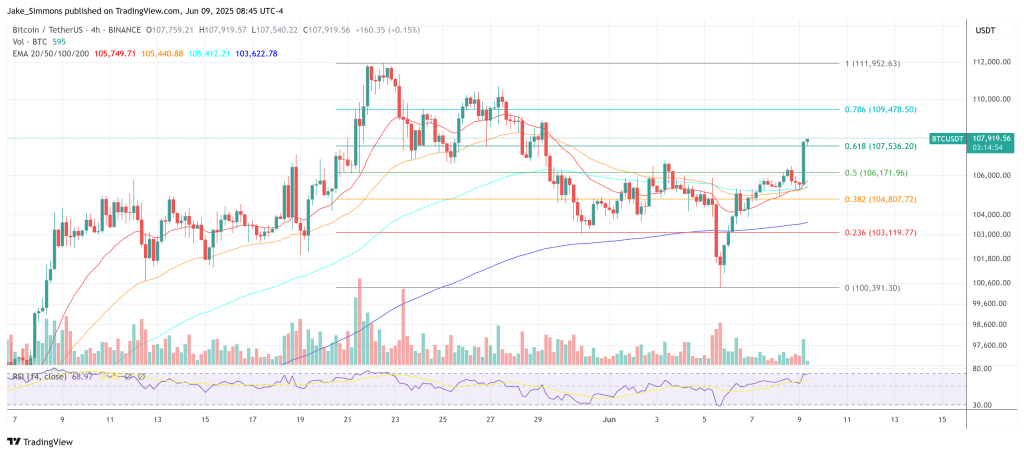

Singapore-based trading firm QCP Capital opened its Monday note with a blunt assessment: “Implied vols continue to come under pressure, with BTC stuck in a tight range as summer approaches.” In the options house’s telling, the market is drifting into the northern-hemisphere holiday season much as it did a year ago, when one-month at-the-money (ATM) volatility collapsed from 80 vols in March to barely 40 vols by July and spot repeatedly “failed to decisively breach the $70k level.” The difference this year is the new, higher plateau: BTC has sat between $100,000 and $110,000 for most of the past three weeks.

The calm is visible beyond Deribit’s options screens. Deribit’s DVOL index, which tracks 30-day implied volatility, is hovering just above 40—one of its lowest prints in more than two years. Realised volatility is even quieter, so even one-year lows on implieds still look “optically rich,” QCP argues. That valuation gap has encouraged traders to sell gamma: perpetual open interest has slipped and the favourite hedge-fund basis trade—long spot via the new ETFs, short futures—has unwound, taking what QCP calls “the natural bid for vol” out of the market.

Related Reading

Flows in the listed options market confirm the malaise. Dealers report that July upside strikes around $130,000 and $140,000 are being rolled out to September “in meaningful size,” effectively pushing bullish timelines further down the curve. Meanwhile, Deribit’s put-skew has flattened as short-dated hedges expire worthless—a dynamic that often precedes a directional move once macro catalysts arrive.

This Week Could Break Bitcoin’s Lull

Those catalysts line up uncomfortably close. On Wednesday the Bureau of Labor Statistics will publish May consumer-price data. April’s headline CPI rose a modest 0.2% month-on-month and 2.3% year-on-year, while core prices advanced 0.2% on the month and 2.8% on the year.

Economists look for headline CPI to quicken to 0.3% on the month and 2.5% year-on-year, with core CPI seen edging up to 0.3% and 2.9% respectively. Producer prices follow on Thursday: April’s PPI fell 0.5% on the month yet still printed 2.4% year-on-year. The consensus expects May PPI to rebound 0.2%, leaving the annual rate near 2.4%.

Inflation is not the only macro variable in play. Friday’s stronger-than-expected US non-farm payrolls report—139,000 jobs versus a 130,000 consensus—rekindled dollar strength and knocked gold more than one percent lower, but BTC “remained conspicuously unmoved,” QCP noted. The same divergence is visible this morning: US equity futures are slightly softer, spot gold is bid on safe-haven demand, and bitcoin is trading virtually unchanged.

Geopolitics may supply the spark that inflation data has so far failed to ignite. Senior US and Chinese officials meet in London today (Monday) in what both sides are calling a push for a limited trade deal that would dial back export-control threats and myriad retaliatory tariffs.

The talks matter for crypto because tariffs have been feeding directly into the CPI basket and—via global risk sentiment—into bitcoin demand. “A clean break below $100k or above $110k would likely reawaken broader market interest,” QCP wrote, “but we currently see no obvious near-term catalyst to drive such a move.” Trade headlines could change that calculus in a single newsflash.

Related Reading

Institutional positioning likewise hints at fatigue. US regulatory filings show that large hedge funds trimmed spot-ETF holdings in the first quarter as the lucrative cash-and-carry spread compressed. Net inflows across the 11 US bitcoin ETFs have slowed to a trickle since late May, leaving cumulative additions at roughly $44 billion—unchanged for almost a fortnight, according to Farside data.

For now, the market’s centre of gravity is exactly where QCP says it is: inside the $100,000–$110,000 corridor. Volatility sellers continue to collect premium, and the risk-reward for momentum traders remains poor. Yet with CPI, PPI and high-stakes trade negotiations all landing inside a 72-hour window, the premium that option writers are harvesting could quickly look meagre.

If the inflation data surprise to the upside, a repricing of Fed-cut expectations could turn last week’s equity rally into a risk-off wobble, yanking bitcoin below six figures for the first time since April. Conversely, a benign print combined with even a symbolic easing of tariff rhetoric could flip the narrative to “soft landing, structural bid via ETFs,” reigniting topside optionality into the June quarter-end. In that scenario the rolled-out September $140,000 calls might come alive far sooner than their buyers now expect.

Either way, the clock on bitcoin’s summer doldrums is ticking loudly. “Without a compelling narrative to spark the next leg higher, signs of fatigue are emerging,” QCP warns. The narrative candidates arrive this week; whether they supply ignition or simply more noise will decide whether 2025’s range trade breaks—or cements itself as the dominant theme of another crypto summer.

At press time, BTC traded at $107,919.

Featured image created with DALL.E, chart from TradingView.com

Read the full article here