Despite a week of price consolidation for Bitcoin (BTC), emerging digital asset legislation may provide the next significant catalyst for the world’s first cryptocurrency.

Upcoming stablecoin rules, such as the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, may lay the foundation for a Bitcoin cycle top of over $150,000, according to Alice Li, investment partner and head of US at crypto venture capital firm Foresight Ventures.

Meanwhile, venture capitalist (VC) interest has slumped. The number of VC deals closed recorded its lowest month of the year in May, with just 62 investment rounds resulting in $909 million raised.

A challenging “macro backdrop” paired with “higher-for-longer policy rates, jittery bond markets and fresh tariff headlines have made it harder for risk assets to get new M&A deals over the finish line,” Patrick Heusser, head of lending at Sentora and a former investment banker, told Cointelegraph.

Bitcoin reserve, stablecoin regulations big 2025 market catalysts, says VC

Improving regulatory clarity in the United States may push Bitcoin past $150,000 during the current market cycle, according to Alice Li, investment partner and head of US at crypto venture capital firm Foresight Ventures.

During Cointelegraph’s Chain Reaction X Spaces show on June 3, Li said the crypto market’s 2025 rally had been driven mainly by shifting US policy.

“One of the strongest drivers is definitely the policy change,” she said, referencing US President Donald Trump’s Bitcoin reserve approval and stablecoin policy developments as the main catalysts for Bitcoin price upside in 2025.

“Stablecoin will be one of the strongest places that I would invest long term,” she added, citing regulatory progress in the US.

Li’s comments came as the industry was awaiting a full Senate vote on the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which aims to set clear rules for stablecoin collateralization and mandate compliance with Anti-Money Laundering laws.

Ethereum reclaims DeFi market as bots drive $480 billion stablecoin volume

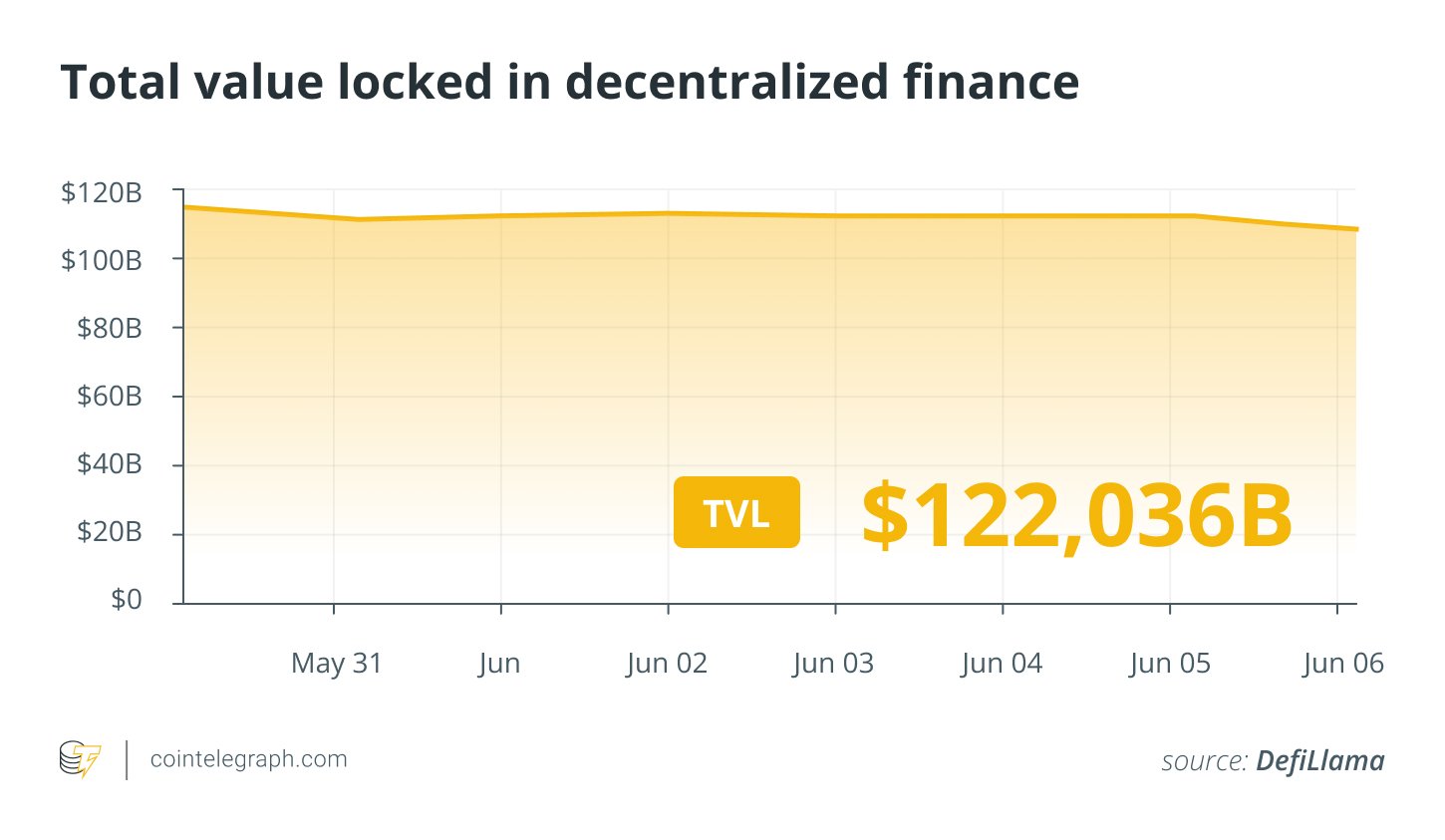

The Ethereum network is staging a comeback in 2025 as bot-driven activity and stablecoin growth push the mainnet back into the center of decentralized finance (DeFi).

On June 4, crypto trading platform Cex.io reported that automated bots facilitated 4.84 million stablecoin transfers on Ethereum’s layer-1 blockchain in May. The volume reached $480 billion, its highest to date.

Illia Otychenko, the lead analyst at crypto exchange Cex.io, linked the activity surge to lower transaction fees in the first quarter of 2025, which helped reverse a multi-year trend of liquidity and user migration to rival blockchains and Ethereum layer-2 networks.

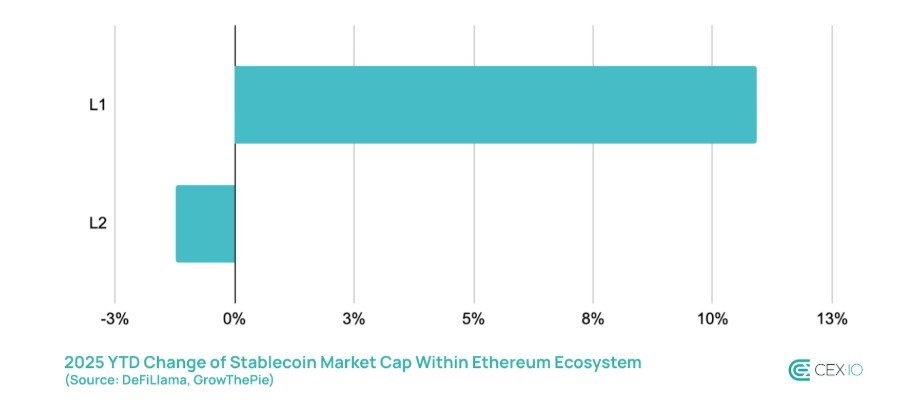

Because of this, the mainnet’s stablecoin market capitalization grew by 11% in 2025, taking market share away from its layer-2s. While the mainnet recouped stablecoin market share, the combined stablecoin market on L2s only shrank by 1%.

Binance co-founder CZ proposes dark pool DEXs to tackle manipulation

Binance co-founder Changpeng “CZ” Zhao proposed creating a dark pool perpetual swap decentralized exchange (DEX) to prevent market manipulation.

In a June 1 X post, Zhao said he has “always been puzzled with the fact that everyone can see your orders in real-time on a DEX.”

“The problem is worse on a perp DEX where there are liquidations,” he said.

Zhao added, “If you’re looking to purchase $1 billion worth of a coin, you generally wouldn’t want others to notice your order until it’s completed.” This is to prevent front-running and maximum extractable value (MEV) bot attacks, which can result in increased slippage, worse prices and higher costs.

His comments followed the liquidation of nearly $100 million in Bitcoin long positions on Hyperliquid reportedly held by a trader known as James Wynn. The event, which occurred after Bitcoin fell below $105,000, sparked claims on X that some users had coordinated to “hunt” Wynn’s liquidation.

One X user claimed that Tron co-founder Justin Sun showed interest in participating, but the claim remained unconfirmed. He also went so far as to invite Eric Trump, the son of US President Donald Trump, to the group.

RWA token market grows 260% in 2025 as firms embrace regulating crypto

The tokenization of real-world assets (RWAs) surged in the first half of 2025 as increased regulatory clarity fueled broader adoption of blockchain-based financial products.

Real-world asset tokenization refers to financial and other tangible assets minted on the immutable blockchain ledger, increasing investor accessibility and trading opportunities for these assets.

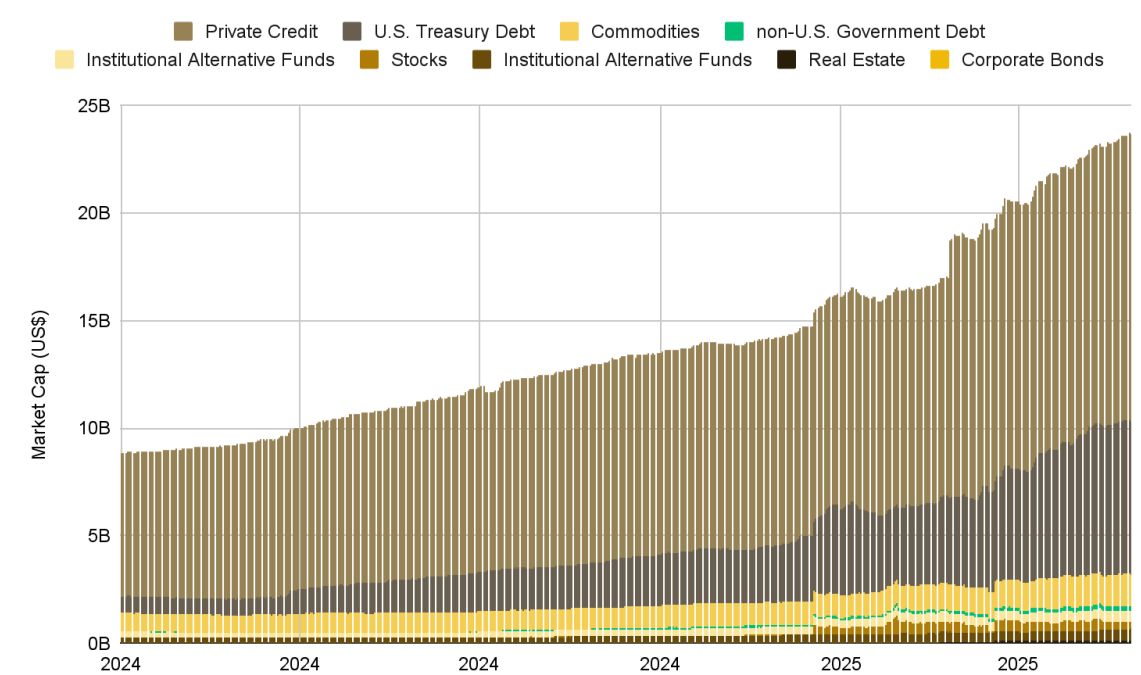

The RWA market surged more than 260% during the first half of 2025, surpassing $23 billion in total valuation. It was $8.6 billion at the beginning of the year, according to a Binance Research report shared with Cointelegraph.

Tokenized private credit led the RWA market boom, accounting for about 58% of the market share, followed by tokenized US Treasury debt, which accounted for 34%.

“As regulatory frameworks become clearer, the sector is poised for continued growth and increased participation from major industry players,” the report said.

RWAs have no dedicated regulatory framework and are considered securities by the US Securities and Exchange Commission (SEC). However, the sector still benefits from regulatory developments in the broader crypto space.

BitoPro confirms $11.5 million exploit, says withdrawals unaffected

Taiwan-based cryptocurrency exchange BitoPro confirmed a security breach that led to the loss of more than $11.5 million in digital assets from its hot wallets on May 8.

The suspicious transactions, which occurred across hot wallets on Ethereum, Tron, Solana and Polygon, saw asset outflows to decentralized exchanges (DEXs) where they were later marked as sold, according to onchain investigator ZachXBT.

Despite the incident, BitoPro did not disclose the exploit on X or Telegram for several weeks, ZachXBT said in a June 2 post on X.

Blockchain data showed assets were deposited into cryptocurrency mixer Tornado Cash or bridged to Bitcoin via THORChain, patterns often employed by hackers to make funds anonymous and untraceable.

On May 9, BitoPro announced a maintenance period for the exchange, which was resolved on the same day. However, many users have since reported being unable to withdraw USDt (USDT).

Three weeks after the incident, BitoPro confirmed it had suffered a wallet exploit. In a June 2 Telegram post, the exchange said the breach occurred during a wallet system upgrade, when an attacker exploited an “old hot wallet” during internal fund reallocation.

DeFi market overview

According to data from Cointelegraph Markets Pro and TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week in the red.

The DeXe (DEXE) token fell over 30%, staging the biggest decline in the top 100, followed by the Virtuals Protocol (VIRTUAL) token, down 24% on the weekly chart.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.

Read the full article here