Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin’s recent recovery has encountered resistance as the asset remains range-bound between $93,000 and $97,000. After briefly climbing late last month, Bitcoin has struggled to maintain upward momentum since then.

At the time of writing, BTC is trading at approximately $94,305, reflecting a modest 1.3% decline over the past day. While price action has slowed, activity on the backend of the market suggests underlying shifts in investor behavior.

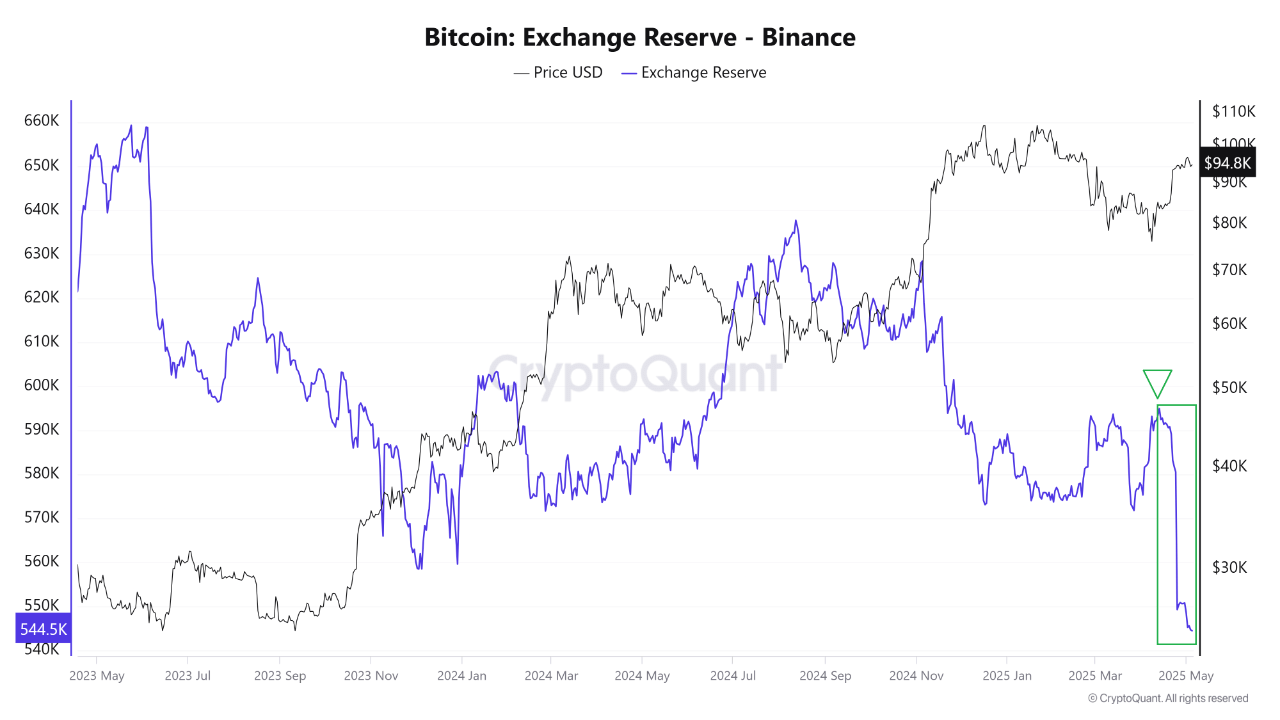

New on-chain data points to a significant decrease in Bitcoin reserves held on Binance, the world’s largest cryptocurrency exchange by trading volume.

Related Reading

One of CryptoQuant’s contributors, Amr Taha, highlighted the development in a recent QuickTake post, signaling that over 51,000 BTC have been withdrawn from Binance wallets since mid-April.

This drop from roughly 595,000 BTC to around 544,500 BTC could indicate a recalibration in investor strategy, with growing interest in long-term holding or redeployment of assets outside centralized platforms.

What’s Driving the Bitcoin Outflows from Binance?

According to Taha, multiple factors may be contributing to this steep decline in exchange-held reserves. One explanation involves institutional investors and long-term holders moving their Bitcoin into cold storage.

This off-exchange behavior is typically interpreted as a signal of longer-term conviction, as these participants seek to secure assets while reducing the likelihood of short-term selling. Given the rise of custodial solutions and more institutional-grade wallets, this trend may reflect maturing market behavior.

Another key factor could be the increasing use of Bitcoin within decentralized finance (DeFi) and cross-platform arbitrage strategies. Taha noted that entities may be withdrawing BTC to access yield opportunities or deploy capital in other blockchain ecosystems.

Additionally, the recent positive flows into Bitcoin spot exchange-traded funds (ETFs), especially between April 21 and May 1, where daily net inflows crossed the $2 billion mark on several occasions, may have encouraged larger players to accumulate and withdraw Bitcoin in anticipation of further price appreciation.

Exchange Reserve Trends Offer Signals Amid Price Consolidation

Though Bitcoin’s price has remained largely stagnant over the past week, the shift in exchange reserve data could carry significant implications for future price action.

Historically, a decrease in exchange reserves, particularly from major venues like Binance, has been associated with supply tightening. As fewer coins are readily available for sale, reduced liquidity can amplify the impact of incoming demand, especially in bullish phases.

Taha emphasized that while short-term market performance may appear indecisive, tracking reserve metrics offers important clues about underlying sentiment.

Related Reading

A consistent drawdown of BTC from exchange platforms often sets the stage for renewed price movement, especially when accompanied by institutional accumulation and long-term holding behavior.

If these patterns persist, they may contribute to reduced sell-side pressure, enabling Bitcoin to challenge its next resistance zones, including the psychological $100,000 level.

Featured image created with DALL-E, Chart from TradingView

Read the full article here