Bitcoin may reach a new all-time high of $110,000 before any significant retracement, according to some market analysts who cite easing inflation and increasing global liquidity as key factors supporting a price rally.

Bitcoin (BTC) has been rising for two consecutive weeks, achieving a bullish weekly close just above $86,000 on March 23, TradingView data shows.

Combined with fading inflation-related concerns, this may set the stage for Bitcoin’s rally to a $110,000 all-time high, according to Arthur Hayes, co-founder of BitMEX and chief investment officer of Maelstrom.

BTC/USD, 1-week chart. Source: Cointelegraph/TradingView

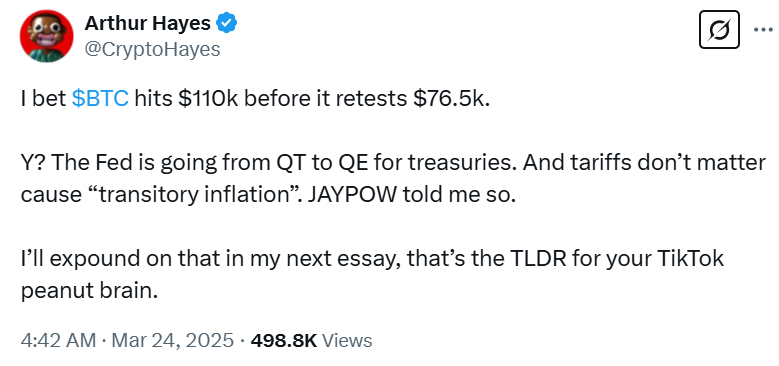

Hayes wrote in a March 24 X post:

“I bet $BTC hits $110k before it retests $76.5k. Y? The Fed is going from QT to QE for treasuries. And tariffs don’t matter cause of “transitory inflation.” JAYPOW told me so.”

Source: Arthur Hayes

“What I mean is that the price is more likely to hit $110k than $76.5k next. If we hit $110k, then it’s yachtzee time and we ain’t looking back until $250k,” Hayes added in a follow-up X post.

Quantitative tightening (QT) is when the US Federal Reserve shrinks its balance sheet by selling bonds or letting them mature without reinvesting proceeds, while quantitative easing (QE) means that the Fed is buying bonds and pumping money into the economy to lower interest rates and encourage spending during difficult financial conditions.

Other analysts pointed out that while the Fed has slowed QT, it has not yet fully pivoted to easing.

“QT is not ‘basically over’ on April 1st. They still have $35B/mo coming off from mortgage backed securities. They just slowed QT from $60B/mo to $40B/mo,” according to Benjamin Cowen, founder and CEO of IntoTheCryptoVerse.

Related: Bitcoin may recover to $90K amid easing inflation concerns after FOMC meeting

Meanwhile, market participants await the Fed’s expected pivot to quantitative easing, which has historically been positive for Bitcoin’s price.

BTC/USD, 1-week chart, 2020–2021. Source: Cointelegraph/TradingView

The last period of QE in 2020 led to a more than 1,000% surge in Bitcoin’s price, from around $6,000 in March 2020 to a then-record high of $69,000 in November 2021. Analysts say a similar setup may be forming again.

Related: Bitcoin reserve backlash signals unrealistic industry expectations

Macro conditions may support Bitcoin’s rally to $110,000

Bitcoin’s recovery to above $85,000 after last week’s Federal Open Market Committee (FOMC) meeting was a bullish sign for investor sentiment that may signal more upside, according to Emmanuel Cardozo, market analyst at real-world asset (RWA) tokenization platform Brikken.

The macroeconomic environment also “supports” a Bitcoin rally to $110,000, the analyst told Cointelegraph.

“Global liquidity has risen, discussions around a US Bitcoin strategic reserve, potentially driving Bitcoin toward that $110,000 mark as BTC liquidity available in exchanges keeps dropping, leading to a supply squeeze scenario,” he said.

“However, a correction to $76,500 aligns with Bitcoin’s historical volatility, often triggered by profit-taking or unexpected market shifts,” he added.

Other analysts also see a high likelihood of Hayes’ prediction playing out.

“Given Bitcoin’s recent close above the 21-day and 200-day moving averages, this bullish momentum aligns with his view. However, the $88K resistance remains a key hurdle,” Ryan Lee, chief analyst at Bitget Research, told Cointelegraph.

Magazine: Bitcoin’s odds of June highs, SOL’s $485M outflows, and more: Hodler’s Digest, March 2 – 8

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here