Bitcoin and global cryptocurrency markets retreated in tandem with U.S. equity benchmarks on Tuesday, as bearish sentiment gripped financial markets. The digital asset ecosystem contracted by 1.89% over 24 hours, slipping to $2.67 trillion, with BTC briefly dipping to $81,138 during trading hours.

Bitcoin Battles Bears: $224M Liquidation Frenzy Erupts Amid Fed Policy Jitters

A crimson tide engulfed digital asset markets as every top-ten cryptocurrency faced downward pressure. Bitcoin ( BTC) retreated 1.84% by midday, brushing against $81,138 at 11 a.m. ET on March 18. DOGE and ADA led declines among major tokens, shedding 4.42% and 4.16%, respectively, while XRP fell 3.7% and solana ( SOL) slipped 3.5%.

March 18, 2025

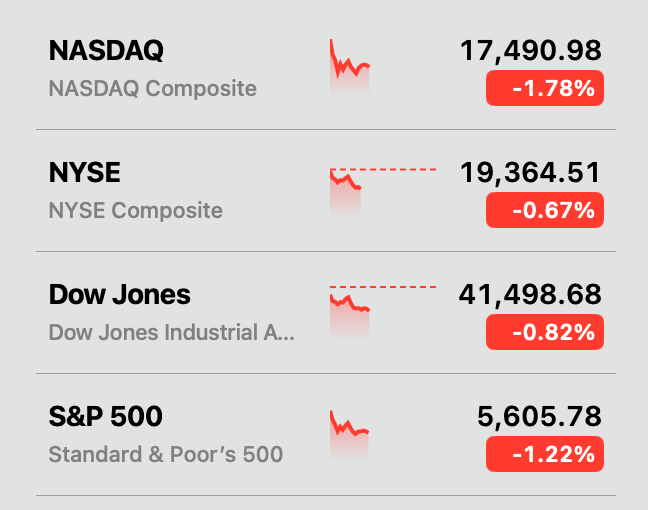

U.S. equities—including the Nasdaq, NYSE, Dow Jones, and S&P 500—similarly faltered. Investors grappled with multiple headwinds: anxiety over potential economic contraction, renewed geopolitical trade tensions, and anticipation of the Federal Reserve’s policy verdict due March 19 at 2 p.m. ET, concluding its two-day convening.

March 18, 2025

BTC’s midday rebound saw it oscillate near $82,000 by 11:45 a.m. ET, following reports of a Hyperliquid whale’s speculative maneuvers. Despite initial losses from a 40x leveraged short position highlighted by Bitcoin.com News, the entity ultimately netted over $9 million. By Tuesday, the same trader held a 5x leveraged long on MELANIA, a meme-inspired token.

Volatility erased $224.5 million from derivatives positions before noon, with $145.86 million stemming from bullish bets. BTC longs accounted for $45.83 million of losses, while ethereum ( ETH) derivatives traders saw $24.96 million vanish. Some 111,642 traders faced liquidations, topped by a $2.18 million BTC futures position on Binance. By 12 p.m., BTC has been struggling below the $82,000 zone.

Read the full article here