This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

After a tough several weeks, today is a happier day on Wall Street.

February’s inflation print gave stocks a surprising but welcome boost this morning after prices last month rose less than expected.

The Consumer Price Index showed prices increased 2.8% year over year — still above the Fed’s 2% target but a decline from the 3% annual increase recorded in January. Economists had projected CPI to come in at 2.9% for the 12 months ended February.

Month over month, consumer prices were up 0.2% in February, a decline from January’s 0.5% gain. That was just under projections, which called for a 0.3% rise last month. Core CPI (excludes volatile food and energy prices) came in at 3.1% annually last month, the lowest yearly increase in almost four years.

A key sector pushing inflation lower is housing, which historically tends to be one of the more stubborn components of the print. Easing housing costs have significantly contributed to the slowdown in inflation for the past two years.

Non-housing costs, on the other hand, have eased less consistently. While Core inflation is slowing for now, this sector includes goods likely to be impacted by tariffs. Food and energy costs are also expected to rise, especially given Trump’s new tariff plans for steel and aluminum, which experts say will increase OCTG costs by 15% annually.

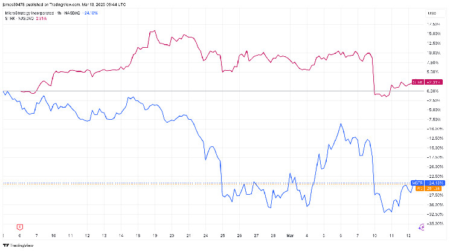

US equities rallied Wednesday morning on the inflation print. The S&P 500 gained as much as 0.8% while the Nasdaq Composite surged almost 1.5% early in the session. At 2 pm ET they were trading 0.4% and 0.9% higher, respectively.

Still, fears over an escalating trade war are weighing on markets. By our estimate, the “tariff trade” is the dominant factor contributing to US equity prices right now, even if a positive inflation print provides short-term relief.

So far, the Fed seems comfortable continuing its interest rate cut pause. Powell last week said the economy is “fine.”

“It doesn’t need us to do anything,” he added.

The latest on the tariff front is more retaliatory efforts against the US. Canada hit the US with a 25% levy on steel while the EU announced additional duties on items including denim, bourbon and poultry.

Read the full article here