Bitcoin active addresses are nearing a three-month high, signaling a potential crypto market capitulation that may stage a price reversal from the latest correction.

Active addresses on the Bitcoin network surged to over 912,300 on Feb. 28, a level not seen since Dec. 16, 2024, when Bitcoin (BTC) traded for around $105,000, Glassnode data shows.

Bitcoin number of active addresses. Source: Glassnode

The surge in active addresses may signal a “capitulation moment” for the crypto market, according to crypto intelligence platform IntoTheBlock. The firm noted in a Feb. 28 post on X:

“Historically, spikes in on-chain activity have often coincided with market peaks and bottoms—driven by panic sellers exiting and opportunistic buyers.”

“While no single metric guarantees a price reversal, this surge suggests the market could be at a crucial turning point,” the post added.

In financial markets, capitulation refers to investors selling their positions in a panic, leading to a significant price decline and signaling an imminent market bottom before the start of the next uptrend.

Related: Altseason 2025: ‘Most altcoins won’t make it,’ CryptoQuant CEO says

Bitcoin must hold above $80,500 to avoid further losses

Bitcoin’s ability to remain above the $80,500 threshold may act as a “potential catalyst for market stabilization,” according to Stella Zlatareva, dispatch editor at digital asset investment platform Nexo.

Zlatareva told Cointelegraph:

“Options data indicates that BTC’s ability to reclaim $80,500 will be a key factor in near-term momentum. A breakout above this level could pave the way for further upside, while a failure to establish it as support may lead to further testing on the downside.”

Related: Trump to host first White House crypto summit on March 7

Still, Bitcoin may revisit this crucial support if its price declines below $84,000.

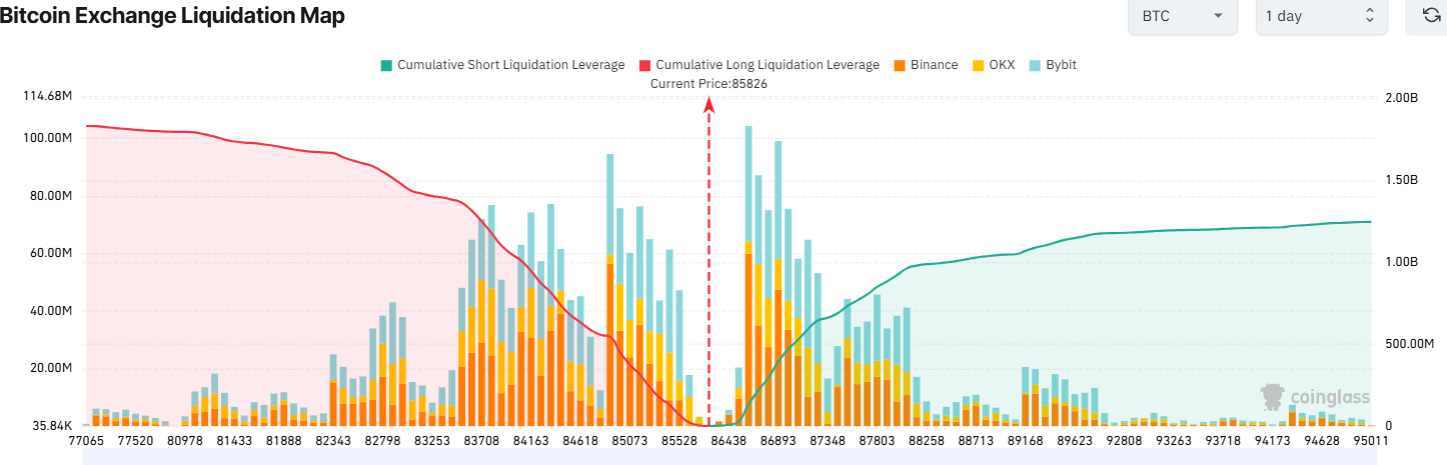

Bitcoin exchange liquidation map Source: CoinGlass

A potential correction below $84,000 would trigger over $1 billion worth of leveraged long liquidations across all exchanges, CoinGlass data shows.

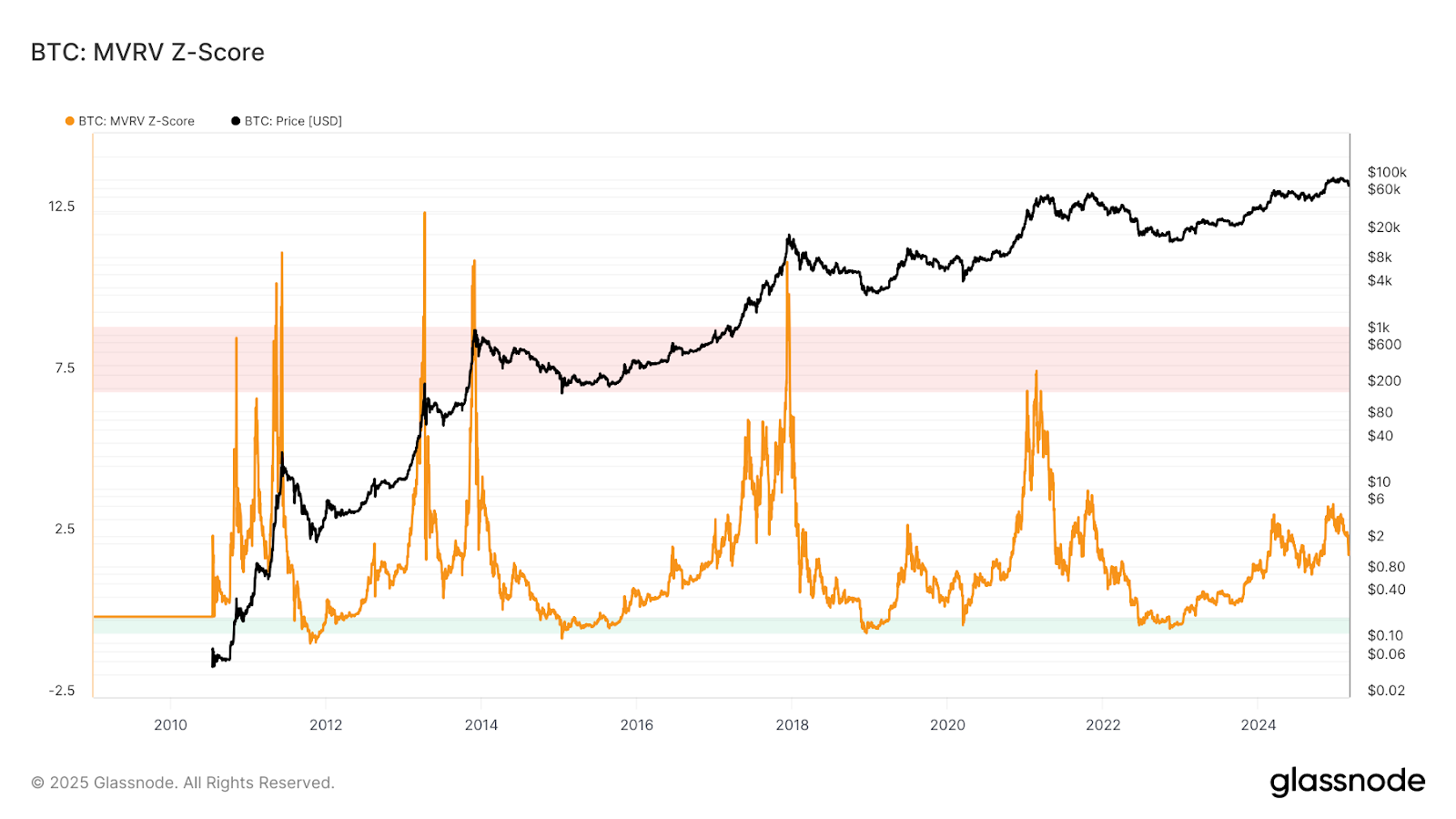

Despite short-term volatility, Bitcoin’s price is closer to forming a market bottom than reaching a local top, according to Bitcoin’s market value to realized value (MVRV) Z-score — a technical indicator used to determine whether an asset is overbought or oversold.

Bitcoin MVRV Z-Score. Source: Glassnode

Bitcoin’s MVRV Z-score stood at 2.01 on March 1, signaling that Bitcoin’s price is approaching the green territory at the bottom of the chart, becoming increasingly oversold, Glassnode data shows.

Magazine: SCB tips $500K BTC, SEC delays Ether ETF options, and more: Hodler’s Digest, Feb. 23 – Mar. 1

Read the full article here