In the past hour, bitcoin has settled into a cozy spot, bobbing gently between $101,536 and $101,747. Over the last day, it’s danced from $99,939 to a peak of $102,658, with a whopping $74.15 billion in trades shuffling around and a market cap hitting the stellar $2 trillion mark.

Bitcoin

On the 1-hour chart, bitcoin‘s price oscillates between $101,000 and $102,500, signaling short-term consolidation following a failed breakout above $102,643. Support is anchored near the psychological level of $100,000. Volume analysis shows a spike accompanying the recent breakout but a lack of sustained follow-through, highlighting weakening momentum. The trend appears sideways, suggesting indecision among traders. Entering near $101,000 with a target of $102,500 might suit short-term strategies, provided the support holds firmly.

BTC/USD 1H chart on Dec. 14.

The 4-hour chart illustrates bitcoin’s recovery from a higher low of $94,249, with current support near $98,000. Resistance is concentrated between $102,500 and $103,000. Volume spikes during upward rallies but weakens on pullbacks, reinforcing bullish dominance. However, the recent consolidation between $101,500 and $102,000 necessitates caution, as it suggests market indecision. Pullbacks toward $98,000–$100,000 may offer buying opportunities, with profit targets near $103,000 or higher if volume confirms a breakout.

BTC/USD 4H chart on Dec. 14.

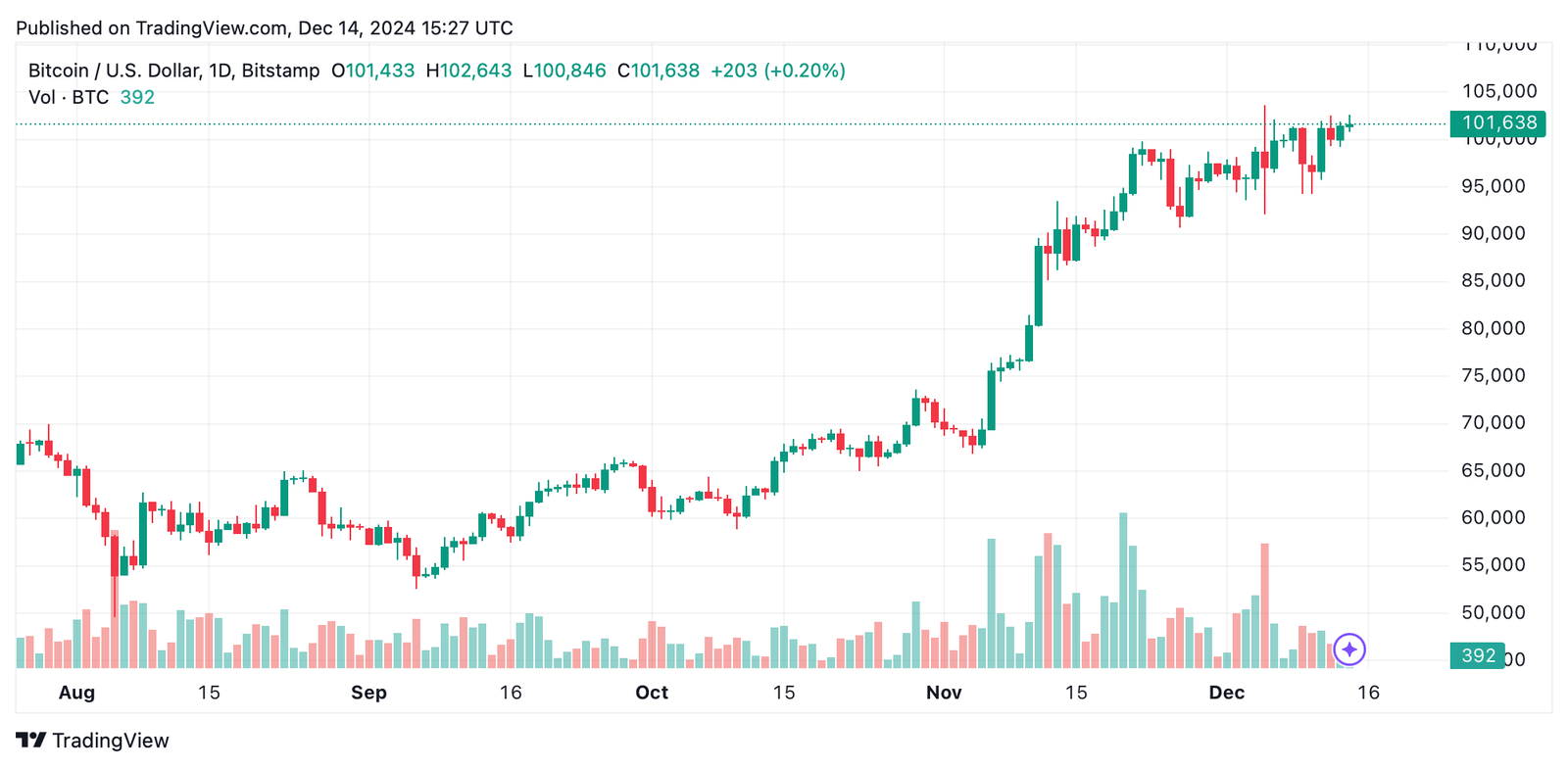

Bitcoin’s daily chart highlights a longer-term uptrend, recovering from $76,554 in late November to test resistance between $103,000 and $104,000. Support levels at $94,000–$95,000 reflect strong demand during recent corrections. A noticeable volume spike during the Dec. 9 recovery candle showcases the current bullish sentiment, though current volume remains subdued. This trend may persist as the holiday season draws near. Consolidation near resistance indicates a pivotal moment, with the potential for either continuation above $104,000 or a pullback to support.

BTC/USD Daily chart on Dec. 14.

Oscillators display mixed signals, with the relative strength index (RSI) and Stochastic remaining neutral, while the awesome oscillator suggests a buy. Conversely, momentum and the moving average convergence divergence (MACD) point to current selling pressure. Moving averages (MAs) favor a bullish outlook, as both exponential (EMA) and simple moving averages (SMA) from 10 to 200 periods remain firmly in positive territory.

Bull Verdict:

Bitcoin’s price action shows strong support at key levels, complemented by a strong uptrend on the daily chart and consistent bullish signals across moving averages (MAs). If resistance at $103,000–$104,000 breaks with volume confirmation, bitcoin could rally to $107,000 or higher, signaling continued bullish momentum.

Bear Verdict:

Subdued trading volume at resistance and mixed signals from oscillators, such as the moving average convergence divergence (MACD) and momentum, suggest caution. A failure to sustain support at $101,000 or a breakdown below $98,000 could trigger a deeper pullback toward the $94,000–$95,000 range, potentially eroding bullish confidence.

Read the full article here