According to the creator of timechainindex.com, Binance, one of the leading cryptocurrency exchanges, has recently experienced “significant outflows.” This activity has reportedly prompted the platform to tap into its cold wallet reserves to manage the situation.

$334 Billion in Play: Centralized Exchanges Face Onchain Scrutiny Amid Bitcoin Highs

The chatter on the onchain grapevine suggests Binance is seeing major withdrawals. Binance stands as a heavyweight in the centralized exchange (cex) arena, not only managing a vast array of digital assets but also safeguarding a significant stash of bitcoin (BTC). On Nov. 19, Sani, the operator of timechainindex.com, shared that the cex platform has been experiencing notable divestments.

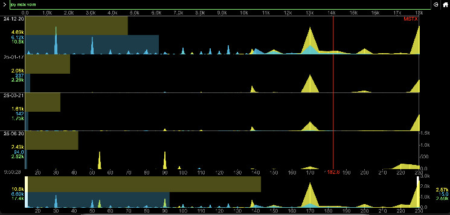

“Binance has been experiencing significant outflows in recent weeks, prompting the exchange to draw from its cold wallet reserves,” Sani stated on X. “[Two] hours ago, they transferred 40,000 BTC between their cold wallets and moved an additional 5,535 BTC to a newly created address, which is likely associated with them. We’ll continue monitoring to track where these funds eventually end up.”

Source: Sani’s post on X via timechainindex.com.

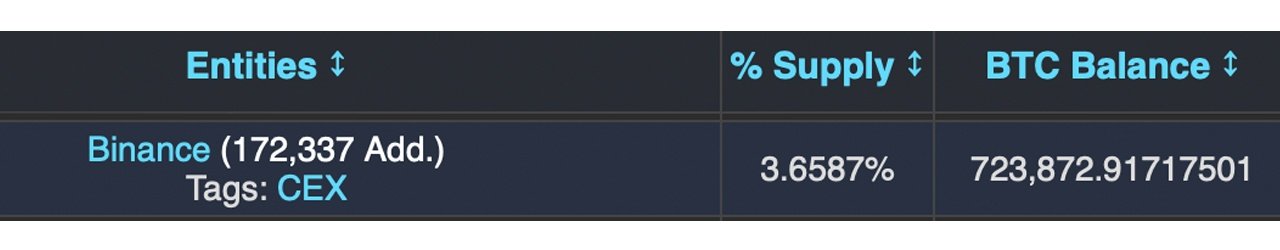

Binance tops the infamous ‘Bitcoin Rich List’ with its Pay-to-Script-Hash (P2SH) address “34xp4,” which holds 248,597.53 BTC—valued at $22.93 billion at press time. This address hasn’t sent an outgoing transaction in nearly two years, last moving funds on Jan. 7, 2023. According to timechainindex.com, Binance manages a staggering 738,349.58 BTC spread across thousands of addresses, worth an impressive $68.08 billion.

Source: timechainindex.com

Only Coinbase surpasses Binance in bitcoin (BTC) holdings, with timechainindex.com reporting that the San Francisco-based exchange secures 1,067,857.30 BTC, valued at $98.47 billion. The same data reveals that centralized exchanges collectively control 3,622,293 BTC, equating to $334 billion. Recent buzz about Binance’s outflows and its tactical use of cold wallet reserves highlights how these reserves help balance the scales during high withdrawal periods.

As a key player in the bitcoin ecosystem, Binance’s actions will always draw intense scrutiny, showcasing how centralized exchanges can shape market sentiment and influence participant behavior. This also sheds light on the immense responsibility cex platforms bear in managing vast digital asset reserves. With bitcoin hitting all-time price highs, the strategies these exchanges adopt will likely set the tone for future market trends.

Read the full article here